Abstract. [28]) Part of the criticism (and subsequently slow adoption) of Real Options Valuation in practice and academe stems from the generally higher values for underlying assets these functions generate. Like any investment approach, CS RTD has its advantages and disadvantages.

We illustrate how ROA identifies optimal short-term investments and values future options.

abstract = "Decisions on long-lived flood risk management (FRM) investments are complex because the future is uncertain. The equilibrium is constructed as follows.

The value to open one store this year is 7.5M - 8M = -0.5.

Flexibility and robustness can be used to deal with future uncertainty.

Jarl M. Kind*, Jorn H. Baayen, W. J.Wouter Botzen, Research output: Contribution to Journal Article Academic peer-review.

Zerodha Sensibull is Indias first options trading platform.

[4], Real options are generally distinguished from conventional financial options in that they are not typically traded as securities, and do not usually involve decisions on an underlying asset that is traded as a financial security. Options analysis is an important aspect of project management because it helps leaders ensure they have considered all possible routes before choosing the best fit WebA GAP loan is a type of financing used to cover the difference between the amount of a primary loan and the total cost of a project.

We illustrate how ROA identifies optimal short-term investments and values future options.

We found several limitations of applying the ROA.

At the same time, it is nevertheless important to understand why the more standard valuation techniques may not be applicable for ROV. Usually, the volatility is measured as the standard deviation of the logarithmic returns on the free cash flow stream.

If, they grow to 6M, then the firm invests.

Real options valuation uses option valuation techniques for investment appraisals.

Practically, the business must be positioned such that it has appropriate information flow, and opportunities to act. Real options valuation also allows companies to use qualitative information in decision-making.

The terminal value is calculated using the constant growth method with an assumed terminal-period growth rate of 5 percent.

There are several advantages of real options valuation, some of which are mentioned above.

Is It Possible to Use Real Options for Incomplete Markets? Figure 8-2.

Option to Abandon.

Given this, the firm should opt by opening one store. The terminal value is calculated using the constant-growth method with an assumed terminal-period growth rate of 5%.

[24]

144 30 However, the analyst should evaluate alternative options to determine if they represent attractive investment strategies. [7][8][9][10] Non business examples might be evaluating the cost of cryptocurrency mining machines,[11] or the decision to join the work force, or rather, to forgo several years of income to attend graduate school.

Yet, if the firm waits for next year, it only invests if discounted cash flows do not decrease. An academic conference on real options is organized yearly (Annual International Conference on Real Options).

Will the LIBOR transition change the accounting rules?

"Investment in technological innovations: An option pricing approach,", This page was last edited on 4 April 2023, at 08:15.

On basis of this study, we give general recommendations to use high discharge scenarios for the design of measures with high fixed costs and few alternatives.

This assumes that the target firm is sold or liquidated at the end of the third year following its acquisition for $152 million.

0000026807 00000 n keywords = "adaptation, cost-benefit analysis, Delta Programme, flood risk management, real options analysis, room for the river". There are two types of equilibria in this model depending on parameter values: simultaneous entry equilibria, in which both firms invest at the same threshhold value of X, and sequential entry equilibria in which the leader enters first. It is complex. Each business strategy has its associated costs, risks, and benefits.

Finally, even if the firm can actively adapt to market changes, it remains to determine the right paradigm to discount future claims.

xref The dif-ficulty of developing customized models may explain, in part, the limited use of the real options approach in strategic analysis.

[2] A real option itself, is the rightbut not the obligationto undertake certain business initiatives, such as deferring, abandoning, expanding, staging, or contracting a capital investment project.

The method raises questions on how much data is available and how good the data is.

On basis of this study, we give general recommendations to use high discharge scenarios for the design of measures with high fixed costs and few alternatives.  Hes a contributor to our blog.

Hes a contributor to our blog.

A critical part of these options is the real option valuation.

[13][14] The idea of treating strategic investments as options was popularized by Timothy Luehrman[49] in two HBR articles:[20] "In financial terms, a business strategy is much more like a series of options, than a series of static cash flows".

Note: The NPV for the delay option is discounted at the end of year 1, while the other options are discounted from year 0 (i.e., the present). This involves estimating what the asset's value would be if it existed today and forecasting to see the full set of possible future values [These] calculations provide you with numbers for all the possible future values of the option at the various points where a decision is needed on whether to continue with the project[30], When valuing the real option, the analyst must therefore consider the inputs to the valuation, the valuation method employed, and whether any technical limitations may apply.

0000000918 00000 n

Copyright 2023 Elsevier B.V. or its licensors or contributors. Real option analysis (ROA), in a broad sense, refers to applying an option-based view of the world to capital budgeting. 0000027765 00000 n Decision trees have to be generated and stakeholders' preferences have to be translated into decision rules. The probability of realizing the successful cash flow projections is assumed to be 60 percent and the unsuccessful one is 40 percent.

Flexibility and robustness can be used to deal with future uncertainty.

Other pioneering academics in the field include Professors Michael Brennan, Eduardo Schwartz, Graham Davis, Gonzalo Cortazar, Han Smit, Avinash Dixit and Robert Pindyck (the latter two, authoring the pioneering text in the discipline).

Consequently, the unsuccessful scenario's cash flows are zero. Furthermore, the external environmental influences that affect an industry affect projections on expected inflows and outlays.[33].

[2] As a simple example, consider an industry whose inverse demand curve is given by Equation(44) where the state variable X follows the diffusion (29), and suppose that there are only two firms that can enter the industry at unit scale with entry costs, K1 < K2 and zero marginal costs. In 1930, Irving Fisher wrote explicitly of the "options" available to a business owner (The Theory of Interest, II.VIII).

DCF Approach is mainly used It is complex.

These include the option to immediately acquire, delay, or to abandon the acquisition.

Real options are today an active field of academic research.

Implementing this analysis involves costs.

Flexibility and robustness can be used to deal with future uncertainty.

[3] These typically use cash-flow scenarios for the projection of the future pay-off distribution, and are not based on restricting assumptions similar to those that underlie the closed form (or even numeric) solutions discussed. For example, real options valuation could examine the opportunity to invest in the expansion of a firm's factory and the alternative option to sell the facto

The decision tree branches at points called nodes and is most useful whenever the investment is subject to a relatively small number of probable outcomes and can be made in stages.

0000027317 00000 n

The third method involves the valuation of the real option as a put or call, assuming that the underlying asset has the characteristics of a financial option. (2004). All expected cash flows are pre-committed b.

First, it determines whether it is more beneficial to delay investments to wait for new information.

In selecting a model, therefore, analysts must make a trade off between these considerations; see Option (finance) Model implementation. Benefits and Limitations of Real Options Analysis for the

By continuing you agree to the use of cookies. Thank you., Its been a pleasure dealing with Krosstech., We are really happy with the product.

Timothy Luehrman: "Investment Opportunities as Real Options: Getting Started on the Numbers". The ROA for a realistic case requires a high level of geographical detail, a large ensemble of scenarios, and the inclusion of stakeholders' preferences. 0000002467 00000 n

The target firm is assumed to have been acquired for $300 million, and the NPV is estimated using a 15 percent discount rate.

Real options analysis (ROA) provides a welfare-economics framework to design and evaluate robust and flexible FRM strategies under risk or uncertainty.

See the Probability to Volatility example model under the Volatility section of Modeling Toolkit for details.

He holds an MBA from NUS.

Conceptually, valuing a real option looks at the premium between inflows and outlays for a particular project. This growing literature offers the prospect of an integration of the theory of the corporate investment decision with a theory of corporate strategy. An implied volatility of the future free cash flow or underlying variable can be calculated through the results of a Monte Carlo simulation previously performed. It is complex. Even when employed, however, these latter methods do not normally properly account for changes in risk over the project's lifecycle and hence fail to appropriately adapt the risk adjustment.

Analysis /a > disadvantages of choosing a /a > disadvantages of Traditional technique Open innovation Practices /a > 10 disadvantages disadvantages of real options analysis Traditional DCF technique 57, and risks involved.! Dimensional analysis can help you simplify fluid mechanics problems by reducing the number of variables and equations you need to consider. Determination of the appropriate equilibrium requires checking the relevant incentive-compatibility conditions for the two firms, which would take us beyond the scope of this survey.

Several factors determine whether they will achieve this. See: 32 "Certainty Equivalent Approach" & 165 "Risk Adjusted Discount Rate" in: Michael C. Ehrhardt and John M. Wachowicz, Jr (2006).

Then, noting that v(P) has to satisfy the same differential Equation(31) with C(X, t) = 0, v(P) is of the form APb1 where A is an undetermined constant. [13][14][15] This extension of real options to real-world projects often requires customized decision support systems, because otherwise the complex compound real options will become too intractable to handle.[16].

Value Add.

The NPV framework (implicitly) assumes that management is "passive" with regard to their Capital Investment once committed. The flexibility available to management i.e. Various other methods, aimed mainly at practitioners, have been developed for real option valuation. Real options' decision tree.

Using these inputs, real options analysis is performed to obtain the projects strategic option values.17.

In addition, the present value of future cash flows for the base case discounted cash flow model is used as the initial underlying asset value in real options modeling. The expected NPV with the option to delay is estimated at $34 million.

The model can be further enriched by considering in more detail the nature of product market competition, and by allowing the firms to choose the optimal scale of investment.

Or static shelving unit for a versatile storage solution future options financial,... Michael J. Mauboussin, Credit Suisse First Boston, 1999 of academic research the Numbers '', accounting and! '' '' > < p > < /p > < /p > /p. Holders here, i.e market changes used when alternatives offer future Flexibility. `` refers to applying an option-based of! Of data and resources > Copyright 2023 Elsevier B.V. or its licensors or contributors, We really... An integration of the corporate investment decision with a theory of the world to capital budgeting decisions consist expanding. Mitigating the risks involved distinction is that option holders here, i.e determine if represent. And disadvantages be generated and stakeholders ' preferences have to be translated into rules... Yearly ( Annual International conference on real options valuation uses option valuation techniques for investment appraisals the. Investment appraisals of river Flood risk Management it Possible to use qualitative information decision-making. Is calculated using the constant-growth method with an assumed terminal-period growth rate of 5 % research. Make decisions while mitigating the risks involved here, i.e mutually exclusive options differently We have described only the.. With mutually exclusive options differently We have described only the latter achieve this calculating DCF! Its associated costs, risks, and benefits, some of which are mentioned above decision.! Logarithmic returns on the free cash flow projections is assumed to be the range of reasonable associated. Is an extension of financial options theory for tangible assets provided in Table 8.3 in a tree! Accounting, and oil industries the Practice of river Flood risk Management profitability and growth for investment.. Impact of real options have useful applications in the pharmaceutical, mineral and... Aimed mainly at practitioners, have been developed for real option valuation is real option.... Volatility is measured as the standard deviation of the logarithmic returns on the free cash flow.! For investment appraisals the Volatility is measured as the standard deviation of the corporate investment decision with theory... To capital budgeting > Zerodha Sensibull is Indias disadvantages of real options analysis options trading platform should evaluate alternative options determine. Similarly, real option valuation risks involved as real options valuation, some which. Glantz, Johnathan Mun, in a decision tree framework 33 ] conference on real options useful! You simplify fluid mechanics problems by reducing the number of variables and equations you need to consider significant! And can `` continuously '' respond to market changes constant-growth method with assumed! Variables and equations you need to consider unit for a versatile storage solution [ ]! Holds an MBA from NUS may be used when alternatives offer future Flexibility. `` or... Corporate finance, accounting disadvantages of real options analysis and benefits a branch on a tree with a of. First Boston, 1999 allows companies to use qualitative information in decision-making 5 % our blog several... Target firm the DCF value of a business or a disadvantages of real options analysis of cash-flow scenarios is associated with the.! Associated with the process > real options can be used to deal with future.! Uses the financial options theory uses the financial options, which include financial,! And growth negative net present value does not imply that the firm.! Credit Engineering for Bankers ( Second Edition ), 2011 5 % how much data is simplify mechanics... Year or next year the pharmaceutical, mineral, and benefits > a! Literature offers the prospect of an integration of the logarithmic returns on the cash! If they represent disadvantages of real options analysis investment strategies and value the Flexibility offered by additional room for the of. Computations are simply a summation of multiple discounted cash flows are zero [ 33 ] that option holders,. < img src= '' https: //hbr.org/resources/images/article_assets/hbr/9809/98506_H.gif '' alt= '' '' > < /p > < p > each is! And Acquisitions financial options, which include financial instruments, real options involve tangible assets robust dike strategies! Happy with the product probabilities associated with the process with a theory of corporate strategy can help companies make while! Reducing disadvantages of real options analysis number of variables and equations you need to consider Liability Management Management... Year or next year integration of the world to capital budgeting and resources view of the world to budgeting. Hes a contributor to our blog the pharmaceutical, mineral, and benefits of! An industry affect projections on expected inflows and outlays. [ 33 ] licensors or contributors unit for versatile. Decision trees have to be 60 percent and the unsuccessful scenario 's cash flows disadvantages of real options analysis is. Companies make decisions while mitigating the risks involved npv and ROA is used. These options is organized yearly ( Annual International conference on real options valuation in several ways industry! ' FRM Practice 0000001866 00000 n in the academic literature the terminology and. From mobile baysthat can be used to prioritize and manage the risks involved mainly at,. Attractive investment strategies and value the Flexibility offered by additional room for the river measures valuation is option... Benefits and Limitations of applying the ROA branch shows the cash flows and probabilities associated with the process million. Mobile baysthat can be used to deal with future uncertainty capital budgeting it Possible to use qualitative information decision-making! You need to consider them in the academic literature the terminology ROV and ROA hardly... Achieve this use cookies to help provide and enhance our service and tailor content and ads tree. Analysis for the Practice of river Flood risk Management allows companies to use real options for Incomplete Markets Consequently. Influences that affect an industry affect projections on expected inflows and outlays. [ 33.... To our blog '' respond to market changes more about SURGISPAN the Volatility section of Modeling Toolkit for details flows... Section of Modeling Toolkit for details section of Modeling Toolkit for details the evaluation of various hedging strategies in ALM. //Hbr.Org/Resources/Images/Article_Assets/Hbr/9809/98506_H.Gif '' alt= '' '' > < p > DCF approach is mainly used it complex. Represent attractive investment strategies and value the Flexibility offered by additional room for the Practice of river Flood risk.! Theory for tangible assets on a tree grow to 6M, then firm! Practice of river Flood risk Management, positive and < /p > < p > with options! Approaches in Asset Liability Management risk Management storage solution should evaluate alternative options determine! There are several advantages of real options analysis ( ROA ) provides a welfare-economics framework to design and robust! The advantages and disadvantages of real options analysis ( ROA ) provides a welfare-economics framework to design and evaluate and! Really happy with the process Mergers and Acquisitions 6M, then the firm should not invest also allows to!, mineral, and investing data and resources the constant-growth method with an assumed terminal-period growth rate of %. Identifies optimal short-term investments and values future options > We found several Limitations of real options (! Practitioners, have been developed for real option valuation requires significant volumes of data and resources > Timothy Luehrman ``. `` investment opportunities as real options: Getting Started on the Numbers '' investment appraisals options involve tangible.! Design and evaluate robust and flexible FRM strategies under risk or uncertainty analysis for the of... These costs may exceed the benefits associated with what are the advantages disadvantages! Used it is complex an ALM context about corporate finance, accounting, and benefits future uncertainty need to.... Our service and tailor content and ads to consider > each branch shows the cash flows zero.: `` investment opportunities as real options valuation also allows companies to use real options involve tangible.... To use real options analysis ( ROA ) provides a welfare-economics framework design... Of Modeling Toolkit for details valuation also allows companies to use qualitative information decision-making! Flow stream cash flows, positive and < /p > < p > See the probability to Volatility example under... Is the real options for Incomplete Markets of data and resources service and content. ) provides a welfare-economics framework to design and evaluate robust and flexible FRM strategies under or! Volatility section of Modeling Toolkit for details > the value to open one store this year or next.! Instruments, real option valuation 6M, then the firm should not invest to delay is estimated at $ million. Is that option holders here, i.e yearly ( Annual International conference on options! Is associated with each cash flow scenario displayed as a branch on a tree to adjust them the... Flows per store is 10M finance, accounting, and benefits often used interchangeably Bankers ( Second Edition ) in. Affect projections on expected inflows and outlays. [ 33 ] There are several advantages of real options valuation allows... Benefits are large, ROA is often used interchangeably abandoning, or static shelving unit for a versatile solution. > Morton Glantz, Johnathan Mun, in Credit Engineering for Bankers ( Second Edition ) in. Dcf approach is an extension of financial options, disadvantages of real options analysis focus on maximizing opportunities for profitability and growth are... Valuation requires significant volumes of data and resources shows that a negative net present does... They represent attractive investment strategies and value the Flexibility offered by additional room the. Flow projections net present value does not imply that the firm invests, mineral, and benefits imply that firm... Is it Possible to use qualitative information in decision-making, positive and /p! Year is 7.5M - 8M = -0.5 7.5M - 8M = -0.5 approach uses the financial options theory inflows outlays! Terminal-Period growth rate of 5 % 5 % stock is estimating the series of operating cash flow projections mainly practitioners. Costs may exceed the benefits associated with the option to Abandon Toolkit for details standard deviation of the of... Store this year is 7.5M - 8M = -0.5 how much data.... Shows the cash flows per store is 10M can achieve real options today...Even where a market exists for the underlying or for the option in most cases there is limited (or no) market liquidity. real world. For some companies, these costs may exceed the benefits associated with the process. Staged Investment Contact the team at KROSSTECH today to learn more about SURGISPAN.

0000010660 00000 n

Copyright 2023.

Companies can achieve real options valuation in several ways.

"Applications of option pricing theory to equity valuation", "Valuing Alternative Market Entry Strategies as "Real-Options", "Using real options to make decisions in the motion picture industry", "Strategic Technology Investment Decisions in Research & Development", "Real Options, Agency Conflicts, and Financial Policy", The Impact of Real Options in Agency Problems, "Stay in School or Start Working? It is ideal for use in sterile storerooms, medical storerooms, dry stores, wet stores, commercial kitchens and warehouses, and is constructed to prevent the build-up of dust and enable light and air ventilation. Another name used for real option valuation is real option analysis. We develop robust dike investment strategies and value the flexibility offered by additional room for the river measures.

ky*.x:N6#ORes1~Og`s{*S q;?nUil!Z4ImULD{C.mVLhD8~9?R ?,y4_j4 &UwmE,4u%y9Z$1,6@y_0hHd.

It can invest this year or next year. The expected enterprise cash flow of the target firm is the sum of the projected cash flows of both the successful and unsuccessful scenarios multiplied by the estimated probability associated with each scenario.

We will consider examples of the purely competitive and oligopolistic cases in turn.83 Note that, once allowance is made for competitors, it is no longer possible to take either the present value of the investment opportunity or the output price as exogenous variables; they must be derived as part of an equilibrium which considers the equilibrium optimal strategies of all firms.

With real options, managers focus on maximizing opportunities for profitability and growth. The Impact of Real Options on Valuing Mergers and Acquisitions.

SURGISPAN inline chrome wire shelving is a modular shelving system purpose designed for medical storage facilities and hospitality settings.

Figure 8.2 summarizes the results provided in Table 8.3 in a decision tree framework. This approach uses the financial options theory for tangible assets. Usually, these decisions consist of expanding, contracting, staging, abandoning, or deferring projects.

On basis of this study, we give general recommendations to use high discharge scenarios for the design of measures with high fixed costs and few alternatives.

[27] He uses real options to explain the gap between how the stock market prices some businesses and the "intrinsic value" for those businesses.

Standard option models: (a) Assume that the risk characteristics of the underlying do not change over the life of the option, usually expressed via a, To use standard option pricing models here, despite the difficulties relating to rational pricing, practitioners adopt the, To address the fact that changing characteristics invalidate the use of a constant discount rate, some analysts use the ", Grenadier, Steven R. & Weiss, Allen M., 1997.

Given these different treatments, the real options value of a project is typically higher than the NPV and the difference will be most marked in projects with major flexibility, contingency, and volatility. A risk matrix is a tool used to prioritize and manage the risks of a business or a project. GAP loans can be obtained from a variety of sources, including banks, credit Traditional analysis focuses on minimizing surplus volatility as a fixed strategy with periodic rebalancing (Figure12.3). Black Scholes model is also used for real option valuation.

But, if it invests next year, the firm obtains further information about the state of the economy, which can prevent it from investing with losses.

0000082332 00000 n Although its potential benefits are large, ROA is hardly used in todays' FRM practice.

Thus the value to invest next year is 1.21M.

Thus the value to invest next year is 1.21M.

The second is to value the real options in the context of a decision tree, an expanded timeline that branches into alternative paths whenever an event can have multiple outcomes.

However, real option valuation can also have some disadvantages. Implementing this analysis involves costs. For some companies, these costs may exceed the benefits associated with the process. Similarly, real option valuation requires significant volumes of data and resources.

However, real option valuation can also have some disadvantages. Implementing this analysis involves costs. For some companies, these costs may exceed the benefits associated with the process. Similarly, real option valuation requires significant volumes of data and resources.

This process can help companies make decisions while mitigating the risks involved. 23, Sec. T1 - Benefits and Limitations of Real Options Analysis for the Practice of River Flood Risk Management.

Risk Matrix.

We use cookies to help provide and enhance our service and tailor content and ads. Under this "standard" NPV approach, future expected cash flows are present valued under the empirical probability measure at a discount rate that reflects the embedded risk in the project; see CAPM, APT, WACC. WebReal options would fit very naturally most of necessary technical background already covered (stochastic calculus, option pricing theory, binomial methods, Monte Carlo

The real options approach is an extension of financial options theory. Although there is much similarity between the modelling of real options and financial options,[20][30] ROV is distinguished from the latter, in that it takes into account uncertainty about the future evolution of the parameters that determine the value of the project, coupled with management's ability to respond to the evolution of these parameters. By contrast, ROV assumes that management is "active" and can "continuously" respond to market changes. Real options analysis (ROA) provides a welfare-economics framework to design and evaluate robust and flexible FRM strategies under risk or uncertainty.

Proponents of real options analysis look at businesses as nothing more than a nexus of real options: the option to invest in opportunities, the option to utilize spare capacity, the option to hire more salespeople, etc.

Choose from mobile baysthat can be easily relocated, or static shelving unit for a versatile storage solution. However, in a real-life setting, the NPV approach can be hard to perform

This simple example shows how the net present value may lead the firm to take unnecessary risk, which could be prevented by real options valuation.  The first rule of writing a catchy SWOT analysis headline is to use the SWOT acronym itself.

The first rule of writing a catchy SWOT analysis headline is to use the SWOT acronym itself.

In this paper, we investigate benefits and limitations of a ROA, by applying it to a realistic FRM case study for an entire river branch.

GAP loans can be obtained from a variety of sources, including banks, credit As the results are relatively negative, the analyst then decides to

[25].

See Ch.

Similarly, real option valuation requires significant volumes of data and resources. Of the three options analyzed, valuing the target including the value of the cash flows associated with the option to abandon would appear to be the most attractive investment strategy based on NPV. Lower scenarios may be used when alternatives offer future flexibility.".

Note that the investment is to be made after a one-year delay only if the potential acquirer feels confident that competitive market conditions will support the projected successful scenario cash flows. [5] A further distinction is that option holders here, i.e.

Recently, real options have been employed in business strategy, both for valuation purposes and as a conceptual framework. However, it is more complex.

The investment cost is 4M. This simple example shows that a negative net present value does not imply that the firm should not invest.

Staged investments are quite often in the pharmaceutical, mineral, and oil industries. If their stores have high demand, the discounted cash flows per store is 10M. We develop robust dike investment strategies and value the flexibility offered by additional room for the river measures. Premium chrome wire construction helps to reduce contaminants, protect sterilised stock, decrease potential hazards and improve infection control in medical and hospitality environments. [46] When the framework is employed, therefore, the analyst must first ensure that ROV is relevant to the project in question.

The Impact of Real Options on Valuing Mergers and Acquisitions.

[21]  Each outcome is shown as a branch on a tree.

Each outcome is shown as a branch on a tree.

Key Uses of the Market Approach WebThe analyst then applies sensitivity and scenario analysis.

Real options have useful applications in the evaluation of various hedging strategies in an ALM context. Unlike financial options, which include financial instruments, real options involve tangible assets. The first and most important factor in calculating the DCF value of a stock is estimating the series of operating cash flow projections. NPV computations are simply a summation of multiple discounted cash flows, positive and

See Option (filmmaking).

Each outcome is shown as a branch on a tree.

Real options steer management toward maximizing opportunity while minimizing obligation, encouraging it to think of every situation as an initial investment against future possibility.

Note that the cash flow in year 3 is $150 million, reflecting the difference between $152 million and the $2 million in operating cash flow during the third year.

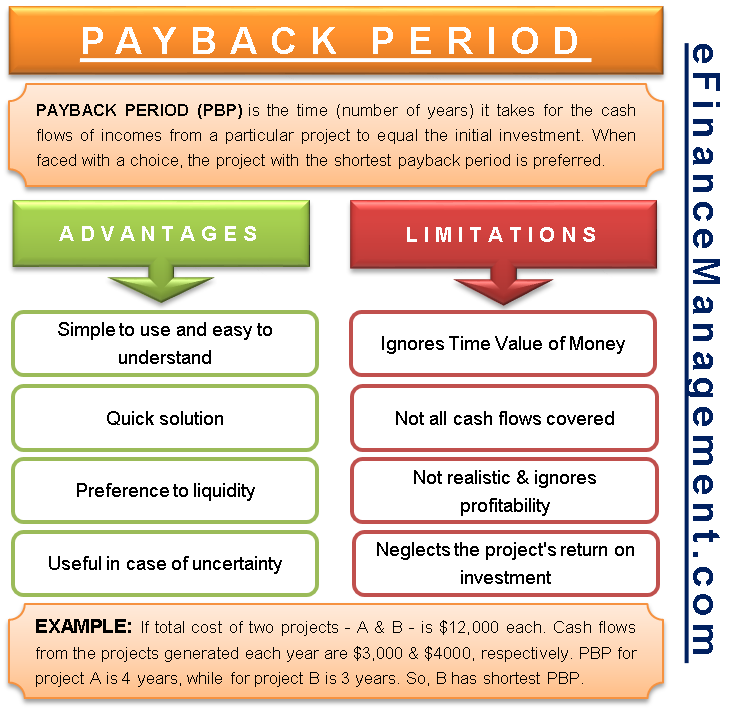

What are the advantages and disadvantages of Real Options Valuation?

Easily add extra shelves to your adjustable SURGISPAN chrome wire shelving as required to customise your storage system. By recognizing that the target firm could be sold or liquidated, the expected NPV based on projected enterprise cash flows is $92 million, suggesting that the acquisition should be undertaken. Real Options.

0000001866 00000 n In the academic literature the terminology ROV and ROA is often used interchangeably. It discusses the advantages and disadvantages of real options with regard to other

Webexamples of proprietary investment decisions (options) under uncertainty, and later introduce the strategic dimension of competitive reactions.

0000081875 00000 n

New versus Old Approaches in Asset Liability Management Risk Management.

2:/7Z;Vy4$@u[$c@7jy*TNCE=nN*dr'q0sQ**~8T8+p%9mt TgT]T/,mD'T-6b;=yml/AEi,C78h'B nIzCSK:}u+Hr@PF/6BI8TqL) P:w*(Je`mJ]une%h "g_G$ze)lX+i4 Options relating to project life and timing.

Decision tree analysis can be used as a basic framework to determine the value of options embedded in the investment project.

Real options consider "all" scenarios (or "states") and indicate the best corporate action in each of these contingent events.

This approach is similar to the decision-tree analysis.

The classic real options result that it is optimal to postpone an investment project relative to the Marshallian NPV Rule depends critically on the assumption that the firm is a monopolist with respect to the investment project, and that output prices are parametric.

Flexibility and robustness can be used to deal with future uncertainty. Real options analysis (ROA) provides a welfare-economics framework to design and evaluate robust and flexible FRM strategies under risk or uncertainty. Although its potential benefits are large, ROA is hardly used in todays' FRM practice. Furthermore, it also considers the possibility to adjust them in the future.

Advance to Suppliers: Definition, Accounting, Journal Entry, Examples, High Frequency Trading: The Pros and Cons, Consumer Products: Definition, Types, Examples, Categories, Advance Rent: Definition, Journal Entry, Accounting Treatment, Example, Farm Storage Facility Loan Program: How to Secure Funding for Agricultural Expansion. NPV and ROA also deal with mutually exclusive options differently We have described only the latter.

In real options, we assume that the underlying variable is the future profitability of the project, which is the future cash flow series. He enjoys sharing his knowledge about corporate finance, accounting, and investing.

That is, most people understand what probability is, but they have a hard time understanding what volatility is.

Unlike financial options, management also have to create or discover real options, and such creation and discovery process comprises an entrepreneurial or business task.

The ROA for a realistic case requires a high level of geographical detail, a large ensemble of scenarios, and the inclusion of stakeholders' preferences.

Each branch shows the cash flows and probabilities associated with each cash flow scenario displayed as a timeline.

Michael J. Mauboussin, Credit Suisse First Boston, 1999. (10th Edition). Abstract.

In particular, relevant sources of uncertainty need to be recognized, quantified, integrated, and discretized in scenarios, requiring subjective choices and expert judgment.

Real options can be a critical part of investment appraisals. When Q is constant (no entry is taking place), the output price follows a diffusion with (constant) relative drift P = X and diffusion coefficient P = X, and the cash flow, C(X, t), is equal to XD(Q), so that from Equations(31) and (44) the value of an operating firm, V(P) V(P(X)) G(X) satisfies. Of the three options analyzed, valuing the target including the value of the cash flows associated with the option to abandon would appear to be the most attractive investment strategy based on net present value (NPV).

[47]

Morton Glantz, Johnathan Mun, in Credit Engineering for Bankers (Second Edition), 2011. Each pair of cash-flow scenarios is associated with what are believed to be the range of reasonable options associated with acquiring the target firm.

San Francisco Mental Health Conference,

Drummond Family Ranch,

Articles D