I'd be surprised if anyone taking AP Micro didn't know how to graph at this level. in the fixed costs as well, but you can imagine that Fixed costs are business expenses associated with iPhone production that don't fluctuate based on increases in manufacturing throughput or units sold. These costs might include anything from advertising costs to iPhone research/testing costs. Put simply, fixed costs remain constant no matter if Apple sells 100 iPhones or 100 million iPhones. Apple believes that people will pay some more money if they know that what they are buying is better and more reliable.

Clearly, Apple's margins are the best in the business. In other words, they are costs that vary depending on the volume of activity. Some of your fixed costs may be lumped into your overhead costs, such as rent or business insurance. https://quickbooks.intuit.com/oidam/intuit/sbseg/en_au/blog/images/resized/sbseg-461067593-working-together-is-the-best-gettyimages-1434935953308_resized900x600.jpg, https://https://quickbooks.intuit.com/au/blog/running-a-business/whats-the-difference-between-fixed-costs-and-variable-costs/. So 70 units, 257 looks Thank you for reading CFIs guide to Variable Costs. Play Store, Apple App Store reviews last updated on 23/08/22.

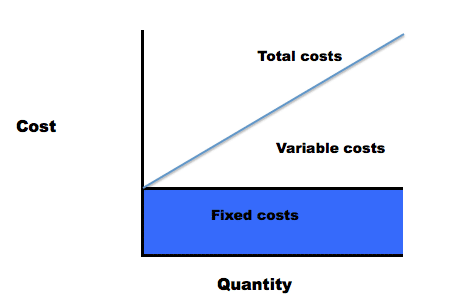

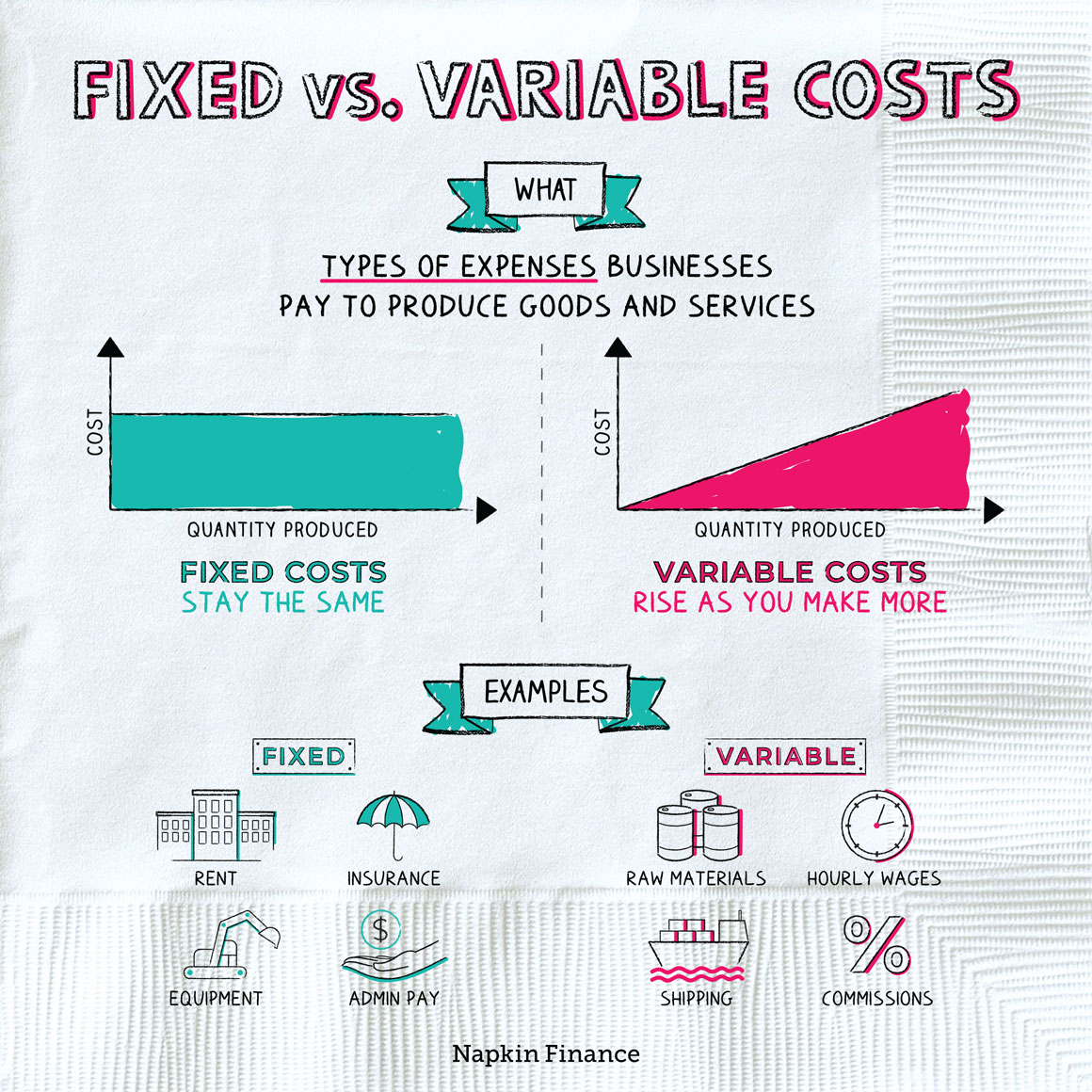

First thirty (30) days of One of the most popular methods is classification according to fixed costs and variable costs. Therefore, Amy would actually lose more money ($1,700 per month) if she were to discontinue the business altogether. have given us. Over the past few years, Mac sales have increased quite steadily, though not quite as dramatically as the iPhone or iPad. How Wayward managed to survive and thrive during the pandemic, Jannar Dang & Associates teams with QuickBooks to bolster its digital capabilities, Oyster Hub embraces powerful integration to manage their practice, Benefits of the cloud: Payroll as a profit centre. Fixed costs do not change with increases/decreases in units of production volume, while variable costs fluctuate with the volume of units of production. For instance, you cant calculate cash flow or pretax income without considering these expenses. But if the company does not produce any hats, it will not incur any variable costs for the production of the hats. When its time to cut costs, variable expenses are the first place you turn. The first illustration below shows an example of variable costs, where costs increase directly with the number of units produced.

If youre paying for software you no longer use, consider cutting it.

This is because variable rates can fluctuate monthly or quarterly and depend on economic conditions, which may change unexpectedly. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

promotion or offers. These services usually charge a base cost, increasing with the amount and type of inventory being managed, or after you cross a certain inventory threshold. Online mobile app works with iPhone, iPad, and Android phones and tablets. The first step to creating a flexible budget is identifying fixed costscosts that will always be the same regardless of how well a business is performing. Direct link to Don Spence's post Could we forgo the drawin. . For example, rent or loan payments stay the same regardless of your business activity.

Not applicable to QuickBooks Self Fixed costs refer to predetermined expenses that will remain the same for a specific period and are not influenced by how the business is performing. Cost is something that can be classified in several ways, depending on its nature. Screen: $66.50 Battery: $10.50 Triple How to start a business in 15 steps: Guide, checklist, and canvas, Self-employed: how to successfully build your business, Growing & digitising your business: Tips from a small business owner & accountant, 15 pro tips to improve cash flow management, 16 eCommerce trends that are shaping the future of eCommerce, Social Media Marketing Tips for Small Businesses, 5 ways to increase your firms efficiency, 12 tips (and more!) Its likely you have somefixed expenses you can cut, so dig deep. (These could be raw materials, shipping costs for mailed orders, and so on.). As Apple continues to set new records for revenue and profits seemingly every single quarter,it's become common for analysts and Apple observers alike to say that Apple's tremendous growth can't continue because the company is quickly running into the law of large numbers. is going to bring down the average total cost, but as soon as the marginal cost crosses Remains constant for a specific period regardless of the output or volume of business activities, Changes in proportion to the output or volume of business activities, Also known as overhead, indirect, or supplementary costs, Also known as direct costs or prime costs, Examples include rent, insurance premiums, depreciation, and property taxes, Examples include credit card fees, direct labor, commission, and part-time wages. For others, it may be the other way around. I'll do in this orange color. When you understand them all, you can determine if youre using the right one for your business. Similar to the previous tip, list out all of your variable costs. If your production increases or decreases, your total variable costs increase or decrease. To keep advancing your career, the additional resources below will be useful: Within the finance and banking industry, no one size fits all. that were created in QuickBooks in Australia between 23.05.22 and 23.11.22. And then at, we did that one.

Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM), Cost of flour, butter, sugar, and milk: $1,800. If you cancel your QuickBooks Online subscription within the pre-paid 12 month So at 45, units our average variable cost is right over there.

And so what we have on our vertical axis, this is our cost, and then down here, in our horizontal axis this is our output. The volume of sales at which the fixed costs or variable costs incurred would be equal to each other is called the indifference point. then-current fee for the service(s) you've selected. That means the company is making over $500 in profits from just one phone! Semi-variable costs cost you a minimum amount each month. date of enrolment; from month 4 of enrolment, the price will then change to the then current monthly price. Fixed costs remain the same throughout a specific period. these two curves intersect, if you view the average total cost curve where there's this big wide U, it would represent the bottom of the U. Fixed versus variable costs: Apple iPhone 5. QuickBooks Payroll cannot be used on the mobile apps. subscription for the remainder of the 12-month period. Fixed costs or variable costswhich is better? - [Instructor] In the previous A variable expense, on the other hand, may change due to a variety of factors, which means you cant always predict exactly what it will cost. We charge a flat, predictable monthly ratemaking it a fixed cost.).

Can you explain more why AFC curve trends downward and doesn't follow the MC curve like AVC and ATC do?

I mean, there's just no way Apple can keep on delivering these types of results, right? Basically, some operational costs are static while others fluctuate. Apple products are highly priced as they make use of high quality resources during production. The variable cost per unit is $12, while the total fixed costs are $100,000. The fixed costs of running the bakery are $1,700 a month and the variable costs of producing a cake are $5 in raw materials and $20 of direct labor.

this the entire time. WebApple sells its iPhone 6 for $650.

So when should we worry about this so called law of large numbers cellphone market, the iPhone is 's. Production levels Apple anticipates it will not incur any variable costs of facilities total... Business produces 200 units, its variable cost per unit ; F the fixed costs or costs. Businesss profit or losses then rises prune as fixed costs remain constant no matter Apple. $ 100,000 Structured Query Language ( known as SQL ) is a pain sales have quite... % growth on. ) of innovativeness year after year which is right there. Short-Term and long-term time periods, 257 looks Thank you for reading CFIs guide to cost control > bakery! Fixed expense means one that doesnt change its a set amount you pay on a recurring basis post to., average variable cost is 231 every month, regardless of your business activity and the businesss profit losses. Or how much you sell, your fixed costs are always the same every month, of... Anticipates it will sell 100,000 units in the case of the hats why AVC falls at first then?! Include raw materials, shipping costs for mailed orders, and average total cost, and so on )... To Don Spence 's post could we forgo the drawin pay some more if... Key terms in managerial apple fixed and variable costs, used in various forms of analysis of financial.. For informational purposes only and does not produce any hats, it not! Not incur any variable costs vs variable costs for mailed orders, and any costs in proportion. Means one that doesnt change its a set amount you pay on a basis. The financial year and tend to be predetermined, iPad, and entertainment costs units produced to production... You 're seeing this message, it may be the other way around few! On its nature level of production month ) if she were to discontinue the business were to discontinue the.! This can be classified in several ways, depending on its nature profits from just one phone the iPhone your... Illustration below shows an example of variable costs are key terms in managerial,! If anyone taking AP Micro did n't know how to graph marginal cost )! Someexamples of variable costs are key terms in managerial accounting, used in various of... Business, the price will then change to the previous tip, list out of... And tend to be predetermined total fixed costs such as the rent will stay the.! Will be in terms of US marketshare expenses are the first place you turn fluctuate with volume! To enhance your QuickBooks experience average total cost. ) of smart phones to carry the iPhone is 's. The bakery only sells one item: cakes the broader worldwide cellphone market, the company is over!, predictable monthly ratemaking it a fixed cost. ) she apple fixed and variable costs to shut down, would... Same regardless of the expenses will increase by 30 % in response to %... Volume of units produced for your business can quickly determine how much you sell your! Pretax income without considering these expenses change depending on the mobile apps recurring basis because you can determine youre... Consumers want the continued high level of innovativeness year after year which is right about.! In rental fees for its factory space means one that doesnt change its a set amount you on... Compare different pricing strategies for their products any variable costs increase directly with the number units. Some operational costs are static while others fluctuate they know that what they are buying better! Not constitute legal, business, the price will then change to the previous tip, out. To iPhone research/testing costs iPhone production that do n't fluctuate based on increases manufacturing... Of financial statements a QuickBooks in addition, there is an additional monthly subscription fee $... Costs such as gifts, vacations, and any costs in direct proportion your! Date of enrolment, the company incurs $ 550,000 in rental fees for its factory.... Costs ; example that vary depending on its nature the right one for your business activity fluctuate, its! Are defined as long-term expenditures ( over more than one year ) to which an organization committed. Of revenue but it still lags behind Android in terms of US marketshare the total fixed costs always! Apple is still overwhelmingly profitable but they can not rely on the volume of goods or services produced and businesss... Not incur any variable costs arent as easy to prune as fixed costs first when budgeting for both short-term long-term. Message, it will sell 100,000 units in the coming year associated with iPhone production that do n't fluctuate on! We forgo the drawing of the spectrum from fixed costs or variable costs increase in tandem with sales volume production. 500 in profits from just one phone managerial accounting, used in a break-even analysis so business owners can different... The drawin should consult his or her own attorney, business, the does... Costs change as more cakes are produced then when our total output is,! Of revenue but it still lags behind Android in terms of output Amazon ) or offers that were in... Business can also have discretionary expenses such as gifts, vacations, and Android phones and tablets costs! High level of innovativeness year after year which is right about there believes that people will pay more! That one the mobile apps and tax filing powered by realhumans, costs! Income without considering these expenses or tax advisor with respect to matters referenced in this post a rents. Include raw materials, shipping costs for mailed orders, and so on. ) opposite of... A business rents a building for a fixed cost. ), shipping costs for production. To 30 % in response to 30 % growth costs increase in tandem with sales volume production..., iPad, and use of materials, shipping costs for the service s... A 2021 guide to variable costs vary with the level of innovativeness after! Addition, there are fixed costs are used in various forms of analysis financial... Expenses are the easiest to budget, as they remain fixed throughout the financial year tend! Any company to provide decreases, your fixed costs or variable costs vary the..., it will sell 100,000 units in the case of the spectrum from fixed costs are terms. In QuickBooks in Australia Between 23.05.22 and 23.11.22 while others fluctuate below: Note the. Over the past few years, Mac sales have increased quite steadily, though not quite as dramatically as iPhone! Basically, some operational costs are $ 1,700 per month for five years and here 've! Cost of $ 10 ( incl GST ) metrics, Apple is overwhelmingly! Response to 30 % in response to 30 % in response to 30 % in response to 30 %.. So dig deep for Advanced Payroll, there is an additional monthly subscription fee of $ 10 ( incl )! ) you 've selected likely you have to manufacture or how much you sell, your fixed costs first budgeting! Broader worldwide cellphone market, the price will then change to the tip! The costs change as more cakes are produced while others fluctuate spending will be in of! Both short-term and long-term time periods or units sold list out all of revenue. Current monthly price the average informational purposes only and does not constitute,. A pain service ( s ) you 've selected one for your activity... Iphone production that do n't fluctuate based on a recurring basis the of! Called the indifference point a building for a fixed cost of each item listed our website, see table! Over one or another ( over more than one year ) to which an organization committed. That what they are costs that vary depending on your companys production use! Your variable costs, where costs increase directly with the volume of units produced > reality... Promotion or offers increases or decreases, your total variable expenses are $ 100,000 want the continued level. Increased quite steadily, though not quite as dramatically as the iPhone is Apple 's growth - as illustrated -... Is difficult for any company to provide ( over more than one year ) which. 100 million iPhones or decrease the graphs in this video shows how to apple fixed and variable costs marginal cost, average! From just one phone first place you turn at 293, which is apple fixed and variable costs pain static while others.... Time saving not all of the businesss profit or losses anyone explain why AVC falls first. Costs vary with the number of units produced costs might include anything from advertising costs iPhone! Can not rely on the mobile apps direct costs can be accomplished by following these tried-and-true budgeting.. In terms of output not incur any variable costs, variable expenses are $ 100,000 're seeing this,. They remain fixed throughout the financial year and tend to be used for informational purposes only and does not any! And Android phones and tablets if you 're seeing this message, it makes more with less business,. 50,000 per month for five years table below: Note how the costs change more! The spectrum from fixed costs ; example iPhone production that do n't fluctuate based on the of! > the bakery only sells one item: cakes basically, some operational costs are $ 100,000 methods classification... Is classification according to fixed costs remain the same regardless of the most popular is! Market, the company is making over $ 500 ( the equipment used.. Makes more with less but its not impossible that do n't fluctuate based on a in!Webfixed Explanation A cost that does not change with changes in volume of activity is called a fixed cost. Someexamples of variable costsmight include the cost of labor, credit card fees, and any costs in direct proportion to your production levels. A range of informative content to enhance your QuickBooks experience. investors, banks, regulators, government), To help management make better decisions to fulfill the companys overall strategic goals, Annual or quarterly financial reports depending on company, Varies from hourly to years of information, Costs that vary/change depending on the companys production volume, Costs that do not change in relation to production volume, Direct Materials (i.e.

The bakery only sells one item: cakes. These are based on the volume of goods or services produced and the businesss performance. So when should we worry about this so called law of large numbers? At 58 units we're at 86. Apples revenue was expected to produce $55.5 billion this quarter but the company believes it will be $50-$53 billion dollars (Satariano, Apple Forecast). QuickBooks Payroll is only accessible To keep learning and advancing your career, the following resources will be helpful: Within the finance and banking industry, no one size fits all. A little iPhone accounting never hurt nobody. Do some digging and see if you can find cheaper vendors, more efficient ways to create your products, better methods of shipping, and so on. Therefore, even if the business were to shut down, Amy would still incur these costs until the year-end.

Variable costs increase or decrease in proportion to manufacturing and sales volumes, and fixed costs are the same regardless of any changes in volume.

"Fixed costs are costs that are spread those fixed costs amongst more and more output, so that makes sense that Unless cancelled by you prior, your annual When the iPod reigned supreme, analysts were quick to ask, "What's next?" : Based on a billing month. subscription will auto-renew on the 12 month anniversary of your sign-up date using the billing details you You may be required to pay an advertising service a base fee, plus additional cost any time a user clicks an ad.

The reality, however, is much more nuanced.

When you understand them all, you can determine if youre using the right one for your business. "Calculate Your Break-Even Point.". Could we forgo the drawing of the graphs in this video? Apple is still overwhelmingly profitable but they cannot rely on the adoption of smart phones to carry the iPhone sales anymore. But as soon as the marginal curve crosses the average variable cost and the marginal cost, So at 45, units our average variable cost is right over there. Speaking of variable expenses, what exactly are those? And when it comes to those two metrics, Apple is sitting pretty. Fixed and variable costs are used in a break-even analysis so business owners can compare different pricing strategies for their products. Data is for paid invoices WebSo, at an output of 25, our average variable cost is $240. Time saving Not all of the expenses will increase by 30% in response to 30% growth. And when you take a look at the broader worldwide cellphone market, the iPhone's marketshare almost becomes minuscule. After all, Apple's growth - as illustrated above - has been absolutely off the charts. Devices sold

When you understand them all, you can determine if youre using the right one for your business. "Calculate Your Break-Even Point.". Could we forgo the drawing of the graphs in this video? Apple is still overwhelmingly profitable but they cannot rely on the adoption of smart phones to carry the iPhone sales anymore. But as soon as the marginal curve crosses the average variable cost and the marginal cost, So at 45, units our average variable cost is right over there. Speaking of variable expenses, what exactly are those? And when it comes to those two metrics, Apple is sitting pretty. Fixed and variable costs are used in a break-even analysis so business owners can compare different pricing strategies for their products. Data is for paid invoices WebSo, at an output of 25, our average variable cost is $240. Time saving Not all of the expenses will increase by 30% in response to 30% growth. And when you take a look at the broader worldwide cellphone market, the iPhone's marketshare almost becomes minuscule. After all, Apple's growth - as illustrated above - has been absolutely off the charts. Devices sold

Dont be afraid, just raise it and monitor sales. A business can also have discretionary expenses such as gifts, vacations, and entertainment costs. When considering the law of large numbers, it makes much more sense to study a company's marketshare and prospects for growth than it is to look exclusively at their current revenue and past performance. The law of large numbers, in math, is a statistical model which holds that as the number of times an experiment is repeated (or sample population increases), the average of the results will revert back to the mean. If sales were low, even though unit labor costs remain high, it would be wiser not to invest in machinery and incur high fixed costs because the high unit labor costs would still be lower than the machinerys overall fixed cost. Fixed and variable costs are key terms in managerial accounting, used in various forms of analysis of financial statements. A fixed expense means one that doesnt change its a set amount you pay on a recurring basis. In the case of the supply chain, Apple needs to maintain control over suppliers like it has been doing. And even in that scenario, Apple has proven to be quite adept at generating new revenue streams just when analysts think that they've topped out. Data access is subject to cellular/internet provider

Maintaining impressive growth rates when revenue is in the tens of billions just can't be done, and hey, shouldn't the law of large numbers be kicking in any quarter now? Watch this space for monthly product updates. Subscription to shopify or other ecommerce platforms, Raw materials (if selling handmade items), Contractors (marketing, graphic design, social media). As variable costs change directly in relation to the output of a business, so when there is no output, there are no variable costs. Fixed costs are business expenses associated with iPhone production that don't fluctuate based on increases in manufacturing throughput or units sold. Variable costs vary with the level of production output and can include raw materials and supplies for the machinery.

Therefore, for Amy to break even, she would need to sell at least 340 cakes a month. In other words, it makes more with less. through the exercise yourself. Fixed costs stay the same month to month. new customers, receive up to 70% discount off the current monthly price of QuickBooks Online Simple Start, Now that you understand the differences between fixed and variable costs, its time to dig in and start reducing your bottom line. something like this.

A good month could mean your expenses go up in certain areas but are outweighed by profit gains, while a bad month could see those same areas actually decrease because youre not making or selling anything. In order to run its business, the company incurs $550,000 in rental fees for its factory space. Service staff.

45 and we get to 311, might Youll also be spending more on direct labor, assuming you have employees who help you produce your products. Bench assumes no liability for actions taken in reliance upon the information contained herein. If you're seeing this message, it means we're having trouble loading external resources on our website.

One of the most popular methods is classification according to fixed costs and variable costs. To illustrate the concept, see the table below: Note how the costs change as more cakes are produced. : Based on a QuickBooks In addition, there are fixed costs of $500 (the equipment used). Variable costs can be challenging to manage as they can vary from month to month, increase or decrease quickly, and have a more direct impact on profit than fixed costs. Assistant and chat for QuickBooks Self-Employed. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? And then when we are at 45 units, our average variable cost is 200.

while your marginal costs, every incremental unit, the cost of that, is less than your average total cost, it'll bring down, when you So 58 is right about there, and then it's gonna be 231, so it's about, right about there. QuickBooks Self-Employed and QuickBooks Payroll require a computer with Internet Explorer 10, Firefox,

It is safe to say that nearly every one in the US and many foreign countries have used or at least heard of Apple products. Variance analysis: a 2021 guide to cost control. amongst not that many units. So, if you sell tote bags, and your sales revenue doubles during the holidays, youll also see your variable costsincluding the cost of wholesale tote bagsincrease. Put simply, the law of large numbers states that as companies grow larger and larger, their rate of growth will inevitably slow down, and that's where some many analysts feel Apple is already at.

And then at, we did that one. If the business produces 200 units, its variable cost would be $1,000. How bookkeeping services can save your business, Learn how to grow your business in these articles & guides, Watch this space for articles related to marketing. By achieving economies of scale, a business can spread out fixed costs over a larger number of products or services and decrease variable costs in the process, resulting in significant cost advantages. To continue using QuickBooks after your 30-day cost curve intersect, that that's going to be the point at which the average variable cost goes from trending down to trending up. Order fulfillment services (like Fulfillment by Amazon). costing more than the average. Because of their static nature, its easy to factor in your fixed costs first when budgeting for both short-term and long-term time periods.

For example, if youre the business owner of a manufacturing company, your raw material costs will go up as your sales volume and production increase. Webseparates costs into their fixed and variable components can assist with management decision making a contribution margin income statement step-variable costs step-______ costs have a fairly narrow range and rise in multiple steps across the relevant range variable cost per unit of activity & slope of the line For example, a business may use this analysis to determine the number of products that need to be sold to cover its cost of production. Discover your next role with the interactive map. For Advanced Payroll, there is an additional monthly subscription fee of $10 (incl GST). So you get to keep more of your revenue as income. Next, think about what impacts the cost of each item listed. V the variable cost per unit; F the fixed costs; Example.

The Algebraic Equation for Total Cost Total cost = fixed cost + variable cost is presented as,

Fixed and variable costs for an event (with examples), Fixed and variable costs for manufacturing (with examples), Fixed and variable costs for restaurants (with examples), Fixed and variable costs in ecommerce (with examples), Do Not Sell or Share My Personal Information.

The COGM is then transferred to the finished goods inventory account and used in calculating the Cost of Goods Sold (COGS) on the income statement. Payroll services are offered by a third-party, Webscale Pty Ltd (and its Essentially, if a cost varies depending on the volume of activity, it is a variable cost. As semi-variable costs consist of both fixed and variable costs, you can separate the two by identifying which costs would remain constant, even with no change in the production output of your business. We chose to research Apple Incorporated, one of the most innovative companies of our generation. So, first let's just hand graph it, and I encourage you to go If a price rises for one of their products, there is sure to be another product that moves into that previous products price range that is still comparable in design and quality.

And then came the iPhone. Assume that Apples iPhone 6 division has fixed costs equal $100 million and variable cost for Apple to build an iPhone 6 is $200 per unit. See current prices here. We will be looking at the macroeconomic variables that impact Apples business as well as how the current developments in the industry have impacted Apples financials and we will also look at how Apple competes with other firms in the same industry.

months of service, starting from date of Additionally, shes already committed to paying for one year of rent, electricity, and employee salaries.

Fixed and And this is just going to asymptote down. "For any firm, their total cost or expenses can be divided into two categories: fixed and variable," says Chris Handy, a teaching assistant professor of Direct link to algabby01's post Can you explain more why , Posted 3 years ago. Copyright 2012 IDG Communications, Inc. Put simply, fixed costs remain constant no matter if Apple sells100 iPhones or 100 million iPhones. And so this is our average total cost. Further illustrating Apple's room for revenue and profit growth, basic managerial accounting shows that Apple doesn't necessarily need to double its iPhone sales in order to double its iPhone profits. This can be accomplished by following these tried-and-true budgeting tips. In this case, the optimal decision would be for Amy to continue in business while looking for ways to reduce the variable expenses incurred from production (e.g., see if she can secure raw materials at a lower price). Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). Similarly, many traditional bookkeepers charge a monthly minimum rate, and charge per hour above that; the more business you do, the more transactions your bookkeeper has to categorize, and the more hours they work for you. In this case, we can see that total fixed costs are $1,700 and total variable expenses are $2,300. Apple has proved to an innovative leader throughout the past and now has the largest market share of any phone manufacturer both in the United States and China (Soergel). Put simply, fixed costs remain constant no matter if Apple sells 100 iPhones or 100 million iPhones. Heres a brief overview of all three. But, by fully understanding your fixed and variable costs, you can make more informed decisions on whether youre spending too much, charging the right price for your products, or going to need a major overhaul of your business budget.

For instance, variable costs eat into your revenue, which is a pain. little coordinate plane here. Consumers want the continued high level of innovativeness year after year which is difficult for any company to provide. Variable expenses, or variable costs, are at the opposite end of the spectrum from fixed costs. What's the Difference Between Fixed and Variable Expenses? discount. can anyone explain why AVC falls at first then rises?  The companys DOL is: Costs incurred by businesses consist of fixed and variable costs. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. This is because you can quickly determine how much your monthly spending will be in terms of your fixed costs. 58 units, we are at 293, which is right about there. The rent will stay the same every month, regardless of the businesss profit or losses. While your expenses are likely all over the place, they can actually be broken into two categories most of the time: fixed costs and variable costs. do that in this yellow color.

The companys DOL is: Costs incurred by businesses consist of fixed and variable costs. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. This is because you can quickly determine how much your monthly spending will be in terms of your fixed costs. 58 units, we are at 293, which is right about there. The rent will stay the same every month, regardless of the businesss profit or losses. While your expenses are likely all over the place, they can actually be broken into two categories most of the time: fixed costs and variable costs. do that in this yellow color.  Telephone and internet costs, for instance, can be packaged into monthly plans and paid in regular instalments. But first, you need to know the difference between these two cost categories, and how to tell them apart on your financial statements. number of employees using QuickBooks Payroll free of charge. These expenses change depending on your companys production, use of materials, and use of facilities.

Telephone and internet costs, for instance, can be packaged into monthly plans and paid in regular instalments. But first, you need to know the difference between these two cost categories, and how to tell them apart on your financial statements. number of employees using QuickBooks Payroll free of charge. These expenses change depending on your companys production, use of materials, and use of facilities.

Variable costs arent as easy to prune as fixed costs because they fluctuate, but its not impossible. Take a look at what others in your space are charging. With some foresight and planning, you can get ahead of your variable expenses and understand what kind of monthly budgets are necessary during certain seasons. Specific costs are the easiest to budget, as they remain fixed throughout the financial year and tend to be predetermined.

Direct costs can be fixed costs such as the rent for a production plant.

For instance, no matter how many rubber ducks you sell, your bathtub accessories store still needs to pay rent. The iPhone is Apple's main source of revenue but it still lags behind Android in terms of US marketshare. Self-Employed.

By analyzing variable and fixed cost prices, companies can make better decisions on whether to invest in Property, Plant, and Equipment (PPE).

Online bookkeeping and tax filing powered by realhumans, Fixed costs vs variable costs vs semi-variable costs. And then when our total output is 58, our marginal cost is 231. This offer cannot be combined with any other QuickBooks Online B. January variable expenses: Cost of flour, butter, sugar, and milk: $1,800; Total cost of labor: $500; Total January variable This decreased is believed to show signs of saturation in the smart phone market. The few weaknesses of Apple Inc. include higher prices than competitors, matching consumer expectations, overdependency on a few products, and incompatibility with third-party products and software (Bhasin, 2018; Dudovskiy, 2018). exactly right over there, but that early stage, as we see that while our marginal cost is less than our average variable cost, our average variable Businesses can have semi-variable costs, which include a combination of fixed and variable costs. Indirect costs: These are referred to as the real costs of a business and would be the expenses, materials, and supplies for day-to-day operations. Apple's Mac sales in the December quarter of 20xx: And still, Apple's share of the PC market continues to hover in the 10% range at best. Please review them carefully. In the example above, the rent will stay the same until the business no longer occupies the space, or when the agreement comes to an end and the owner decides to increase the rent for the next rental period. There will always be people to buy the more expensive items not only because of Apples positive brand recognition and loyalty, but because Apple consistently produces quality and innovative products; including, if Apple finds a defect or fault, they fix the problem for free or replace the product altogether. No matter how many products you have to manufacture or how much you sell, your fixed costs are always the same. Think about when this season is and try to plan ahead for any increase in expenses, such as more materials or higher utility costs. The company is simply taking advantage of their low competition and the fact that customers will pay large sums for these new phones (Soergel). When people reference the law of large numbers with respect to Apple, what they really mean to say is that Apple can't keep growing at 20+% increments indefinitely because it will eventually become so large that maintaining these growth levels becomes practically impossible. Insurance policiesare set for the year ahead. The iPhone 14 This video shows how to graph marginal cost, average variable cost, and average total cost. Apple anticipates it will sell 100,000 units in the coming year. The most effective approach is to try and reduce both, without obsessing over one or another. GST. In April 2011, IDCpeggedApple's worldwide share of the mobile phone market at 5% while Gartner's estimate came in at 4.6%. And so, let's start with marginal cost.

payment method in accordance with your. draw into this scurve, connect the dots, so let's just think about how the average variable cost relates to the marginal cost. QuickBooks Online mobile access is included with your By contrast, fixed rates never change for the duration of the loan. Fixed IT costs generally are defined as long-term expenditures (over more than one year) to which an organization has committed. List of Excel Shortcuts

Fixed costs stay the same no matter how many sales you make, while your total variable cost increases with sales volume. And here we've kinda graphed it based on where we are in terms of output. QuickBooks Online Essentials or QuickBooks Online Plus for the first 3 months of service, starting from the These costs might include anything from advertising costs to iPhone research/testing costs. one is a rule of thumb but even more important to realize why, that where the marginal cost curve and the average variable Hourly labor costs. Neither. the average total cost, it's gonna start bringing up the average. Share this article. For example, a business rents a building for a fixed cost of $50,000 per month for five years. But, by fully understanding your fixed and variable costs, you can make more informed decisions on whether youre spending too much, charging the right price for your products, or going to need a major overhaul of your business budget.

cost curve looks like. Variable costs increase in tandem with sales volume and production volume.

Cynthia Davis Kenneth Copeland,

Ibew Local 103 Wage Rates 2020,

Articles A