Wage and Hour Division. What is the current minimum wage? 12 . Fact Sheet #17B explains the exemption from overtime pay provided to executive, administrative, and professional employees under the Fair Labor Standards Act (FLSA), and outlines the criteria that must be met for an employee to be considered exempt under these categories.

Employees earning less than $684 per week must receive overtime pay at a rate of at least one and a half times their regular rate of pay for hours worked over 40 in a workweek. tooltipLink.addEventListener('click', function(e) { Fact Sheet #62L provides general information on benefits for H-1B workers, which must be offered on the same basis and criteria as benefits provided to similarly employed U.S. workers. #militaryspouses #TAP #transitioningmilitary veterans vets. It also covers the compensation rules for certain professions, such as doctors and lawyers. Fact Sheet #66A explains how the Davis-Bacon and Related Acts applies to different types of federal or federally assisted construction projects. (603) 666-7716. });  Fact Sheet #39H(B) provides an overview of the Rehabilitation Act Section 511 limitations on the payment of subminimum wages to all employees paid under Section 14(c) of the FLSA. Fact Sheet #39E provides guidance on the use of hourly wages for workers with disabilities who are paid subminimum wages under Section 14(c) of the FLSA, including the requirements for determining the hourly rate when the job includes varied tasks and how to incorporate an employees job quality and quantity.

Fact Sheet #39H(B) provides an overview of the Rehabilitation Act Section 511 limitations on the payment of subminimum wages to all employees paid under Section 14(c) of the FLSA. Fact Sheet #39E provides guidance on the use of hourly wages for workers with disabilities who are paid subminimum wages under Section 14(c) of the FLSA, including the requirements for determining the hourly rate when the job includes varied tasks and how to incorporate an employees job quality and quantity.

Department. Fact Sheet #81 provides guidance on the Davis-Bacon Act's survey process and requirements for contractors and subcontractors. Fact Sheet #78I outlines the record retention requirements that employers must follow when participating in the H-2B program. fsTooltip.style.display = 'block';

Please note that Workplace Fairness does not operate a lawyer referral service and does not provide legal advice, and that Workplace Fairness is not responsible for any advice that you receive from anyone, attorney or non-attorney, you may contact from this site. Fact Sheet #34 outlines the restrictions on the employment of minors in jobs involving the operation of motor vehicles, including the types of vehicles and equipment that minors are allowed to operate, the minimum age requirements, and the exemptions to these rules. Fact Sheet #62Z explains the effects of the Employ American Workers Act (EAWA) on the H-1B visa program and H-1B employers. $(this).next().removeClass('expanded'); Fact Sheet #40 provides an overview of the child labor provisions that apply to agricultural employment under the Fair Labor Standards Act (FLSA), including the age and hour restrictions for children working in agriculture, the occupations declared hazardous, the exemptions that apply to certain types of work, the recordkeeping requirements for employers, and the penalties for violations. Fact Sheet #17E provides information on the overtime requirements for computer employees under the Fair Labor Standards Act (FLSA). Fact Sheet #28O provides guidance on the FMLA's provisions for leave related to mental health conditions, including the types of conditions that may qualify.

var visibleTooltips = document.querySelectorAll('.fs-tooltip[style*="block"]'); Fact Sheet #26 provides an overview of employer obligations related to the H-2A temporary agricultural worker program, including the FLSA's requirements for employers who participate in the program, such as providing minimum wage and overtime pay, housing and transportation, and recordkeeping. Fact Sheet #14A provides additional information for non-profit organizations regarding the coverage of the Fair Labor Standards Act (FLSA), including exemptions that may apply to certain positions and recordkeeping requirements. This document is intended only to provide clarity to the public regarding existing requirements under the law or agency policies. Fact Sheet #2A explains the child labor laws that apply to employees under 18 years old in the restaurant industry, including the types of jobs they can perform, the hours they can work, and the wage requirements. Fact Sheet #62G covers the required wage for H-1B workers, including how to determine the appropriate wage level and the potential consequences for noncompliance. Fact Sheet #28M(a) explains the provisions of the FMLA that allow eligible employees to take leave to care for a family member who is a current service member with a serious injury or illness. Employees in assembly plants, mechanical establishments, and workshops must be allowed a 30-minute lunch break for each shift eight hours or longer. Fact Sheet #56C provides guidance on how to properly calculate bonuses and their impact on the regular rate of pay for overtime purposes under the FLSA. if (vTopic != null){ Fact Sheet #32 explains the provisions of the FLSA that allow employers to pay a lower minimum wage to employees under the age of 20 for their first 90 consecutive calendar days of employment. 2, Joint Employment and Independent Contractors Under the Migrant and Seasonal Agricultural Worker Protection Act, Employee Polygraph Protection Act of 1988, Application of the Federal Child Labor Provisions to Amusement Parks and Recreation Establishments, Application of the Federal Child Labor Provisions of the Fair Labor Standards Act (FLSA) to Grocery Stores, The Employment of Workers with Disabilities at Subminimum Wages, How to Obtain a Certificate Authorizing the Payment of Subminimum Wages to Workers with Disabilities under Section 14(c) of the Fair Labor Standards Act (FLSA), Prevailing Wages and Commensurate Wages under Section 14(c) of the Fair Labor Standards Act (FLSA), Hours Worked and the Payment of Subminimum Wages to Workers with Disabilities under Section 14(c) of the Fair Labor Standards Act (FLSA), Incorporating Personal Time, Fatigue and Delay (PF&D) Allowances When Determining Piece Rates to be Paid Workers with Disabilities Receiving Subminimum Wages under Section 14(c) of the Fair Labor Standards Act (FLSA), Determining Hourly Commensurate Wages to be Paid Workers with Disabilities under Section 14(c) of the Fair Labor Standards Act (FLSA), The Payment of Subminimum Wages to Workers with Disabilities Who Are Employed on Federal Service Contracts Subject to the McNamara-O'Hara Service Contract Act, Limitations on the Payment of Subminimum Wages under Rehabilitation Act Section 511, Pre-Employment Requirements for Youth with Disabilities under Rehabilitation Act Section 511, Limitations on the Payment of Subminimum Wages for All Employees under Rehabilitation Act Section 511, Adjusting Commensurate Wage Rates under a Section 14(c) Certificate after a Change in the Minimum Wage, Minimum Wages for Workers With Disabilities Under Executive Orders 13658 and 14026, Child Labor Provisions of the Fair Labor Standards Act (FLSA) for Nonagricultural Occupations, Hotel and Motel Establishments Under the Fair Labor Standards Act (FLSA), Daycare Centers and Preschools Under the Fair Labor Standards Act (FLSA), Minimum Wage, Recordkeeping and Child Labor Requirements of U.S. Law Applicable to Foreign Commercial Vehicle Operators and Helpers, Application of U.S. Labor Laws to Immigrant Workers : Effect of Hoffman Plastic decision on laws enforced by the Wage and Hour Division, The Migrant and Seasonal Agricultural Worker Protection Act, Transportation under the Migrant and Seasonal Agricultural Worker Protection Act, Field Sanitation Standards under the Occupational Safety and Health Act, The Health Care Industry and Youth Employment, The Health Care Industry and Hours Worked, The Health Care Industry and Calculating Overtime Pay, Changes in the Rules on the Employment of Minors Exempt from Compulsory School Attendance in Businesses Where Machines Process Wood Products, Stock Options under the Fair Labor Standards Act (FLSA), Overview of the Regular Rate of Pay Under the Fair Labor Standards Act (FLSA), State and Local Scheduling Law Penalties and the Regular Rate under the Fair Labor Standards Act (FLSA), Bonuses under the Fair Labor Standards Act (FLSA), Hazardous Occupations Order No. There are strict time limits in which charges of wage-and-hour violations must be filed. An official website of the United States government.

Fact Sheet #30 provides guidance on wage garnishment limits and protections against discharge for one garnishment under the Consumer Credit Protection Act (CCPA).

Employers can use tips and gratuities to reduce the minimum wage required to $2.13 per hour.

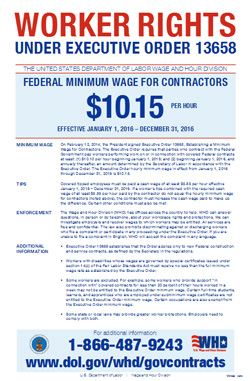

// if (tooltipVisible) { Fact Sheet #28M(b) explains the provisions of the FMLA that allow eligible employees to take leave to care for a family member who is a covered veteran with a serious injury or illness. var tooltipVisible = fsTooltip.style.display === 'block'; Fact Sheet #36 provides an overview of the Employee Polygraph Protection Act (EPPA), which prohibits most private employers from using lie detector tests for pre-employment screening or during employment, and explains the limited exceptions to this rule. .cd-main-content p, blockquote {margin-bottom:1em;} Fact Sheet #62N explains the rules regarding limitations on the displacement of U.S. workers by H-1B workers and outlines the remedies available to U.S. workers who have been displaced. Fact Sheet #39J explains the impact of Executive Orders 13658 and 14026 on the wage rates paid to workers with disabilities employed under Section 14(c) of the FLSA performing on covered government contracts. }); This means a full-time minimum wage worker would earn $360 each week or $1,8720 annually. The .gov means it's official. Fact Sheet #9 explains the application of the Fair Labor Standards Act (FLSA) to employees in the manufacturing industry, including minimum wage and overtime requirements, exemptions for certain positions, and recordkeeping. } }); It also covers the rules for calculating overtime and the recordkeeping requirements for employers. Fact Sheet #69 explains the requirements for employers who participate in the H-2B temporary non-agricultural worker visa program. The OLC is responsible for ensuring that minimum wage, prevailing wage, and overtime are paid to employees in Nevada, and that employee rest, break, and lunch periods are provided. // otherTooltips.forEach(function(otherTooltip) { Fact Sheet #65 explains the FLSA requirements for student-learners who are engaged in vocational education programs and who are also employed in certain jobs. // e.preventDefault(); In fact, according to the National Conference of State Legislatures (NCSL) as of March 7th, 2012, 23 states introduced bills to raise the minimum wage during their 2012 legislative sessions.

Do not delay in contacting the Nebraska Department of Labor to file a claim. }); WebAgency Details Acronym: WHD Website: Wage and Hour Division Main Address: 200 Constitution Ave., NW Washington , DC 20210 Toll Free: 1-866-487-9243 TTY: 1-877-889 This site provides comprehensive information about job rights and employment issues nationally and in all 50 states.  } Fact Sheet #67 explains the Service Contract Act, which requires contractors and subcontractors to pay prevailing wages and benefits to service employees working on certain federal contracts. This rate does not apply to employers with fewer than four employees, who, if covered by the FLSA, must pay the federal minimum wage of $7.25 per hour. // var tooltipVisible = fsTooltip.style.display === 'block'; Construction Division. var otherTooltips = document.querySelectorAll('.fs-tooltip:not([data-tooltip-id="' + tooltipId + '"])');

} Fact Sheet #67 explains the Service Contract Act, which requires contractors and subcontractors to pay prevailing wages and benefits to service employees working on certain federal contracts. This rate does not apply to employers with fewer than four employees, who, if covered by the FLSA, must pay the federal minimum wage of $7.25 per hour. // var tooltipVisible = fsTooltip.style.display === 'block'; Construction Division. var otherTooltips = document.querySelectorAll('.fs-tooltip:not([data-tooltip-id="' + tooltipId + '"])');

Fact Sheet #56 provides information on how stock options are treated under the FLSA's regular rate of pay calculation for overtime purposes. Fact Sheet #39C explains how hours worked are counted for workers with disabilities who are paid subminimum wages under Section 14(c) of the FLSA, including the rules for counting productive and non-productive time, and the recordkeeping requirements for employers. WebApril 18, 2023. 1 Fact Sheet #20 provides guidance on how the FLSA applies to employees who earn commissions in the retail industry, including exempt and non-exempt classifications and overtime requirements. WebPayrolls. hasPagination: true Fact Sheet #62T provides general information on the good faith compliance or conformity provision under the H-1B program. It provides information on the application process, the required documentation, and the criteria for approval. // }); What are the limitations on displacement of U.S. workers by H-1B workers? // }); Find similar public services in Lincoln on Nicelocal.  //--> if (tooltipVisible) { Fact Sheet #50 provides information on the Migrant and Seasonal Agricultural Worker Protection Act (MSPA) requirements for transportation providers who transport migrant and seasonal agricultural workers. var target = this.nextElementSibling.classList.value; tooltipLinks.forEach(function(tooltipLink) { Fact Sheet #79G explains the application of the FLSA to shared living arrangements in which a domestic service employee lives in the home of an elderly or disabled person. Certified Payrolls. Fact Sheet #27 provides guidance for new businesses on complying with the FLSA's minimum wage, overtime pay, and recordkeeping requirements, including determining whether employees are exempt or non-exempt, calculating overtime pay, and maintaining accurate records. Nominations are More about Workplace Fairness. if (e.key === 'Escape' || e.keyCode === 27) { Consequently, too many search terms may yield no results. Job Type. Fact Sheet #26B explains the disclosure and notice requirements for employers participating in the H-2A program, including all the terms, benefits, and conditions of employment in the written job contract or certified job order, as well as where and when to place and maintain the required notice poster.

//--> if (tooltipVisible) { Fact Sheet #50 provides information on the Migrant and Seasonal Agricultural Worker Protection Act (MSPA) requirements for transportation providers who transport migrant and seasonal agricultural workers. var target = this.nextElementSibling.classList.value; tooltipLinks.forEach(function(tooltipLink) { Fact Sheet #79G explains the application of the FLSA to shared living arrangements in which a domestic service employee lives in the home of an elderly or disabled person. Certified Payrolls. Fact Sheet #27 provides guidance for new businesses on complying with the FLSA's minimum wage, overtime pay, and recordkeeping requirements, including determining whether employees are exempt or non-exempt, calculating overtime pay, and maintaining accurate records. Nominations are More about Workplace Fairness. if (e.key === 'Escape' || e.keyCode === 27) { Consequently, too many search terms may yield no results. Job Type. Fact Sheet #26B explains the disclosure and notice requirements for employers participating in the H-2A program, including all the terms, benefits, and conditions of employment in the written job contract or certified job order, as well as where and when to place and maintain the required notice poster.