Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms! Initial Business Privilege Tax Return (Form BPT-IN), Alabamas Terms: Limited Liability Entity vs Disregarded Entity, Our Recommendation for filing your Alabama taxes, Alabama Department of Revenue: Contact Us, Alabama House Bill 391: Reducing minimum tax, Alabama Department of Revenue: Individual & Corporate Tax, Alabama Governor Press Release: Small Business Tax Relief, Alabama Department of Revenue: Forms and Mailing Addresses, Alabama Department of Revenue: How do I make a Payment for Business Privilege Tax, Why you shouldnt form an LLC in Delaware.

Is one of our forms outdated or broken?

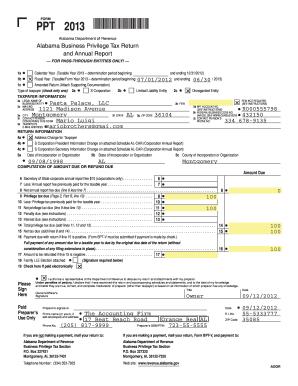

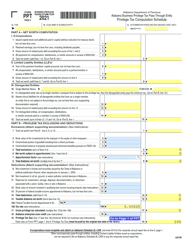

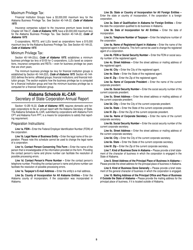

Weve since updated this lesson to make this more clear :), Great tutor for filling out operating agreement, best Ive seenThanks. Share it with your network! WebCorporations doing business in Alabama that have made an S corporation election for federal income tax purposes, must file an Alabama S corporation income tax return which is due by the 15th day of the 3rd month following the close of the S corporation's tax year (March 15th in most years for calendar year filers). WebOpen the alabama ppt and follow the instructions Easily sign the ppt with your finger Send filled & signed alabama 2023 or save Rate the form ppt 2023 4.6 Satisfied 38 votes Let us know in a single click, and we'll fix it as soon as possible. UpCounsel accepts only the top 5 percent of lawyers to its site. Hiring a tax professional will not only help keep your LLC in compliance with Alabama, but it will also give you an advisor to go to for other business questions. I cannot thank you enough for how easy you have made this process of starting a new business. For taxpayers doing business in The Business Privilege Tax Return and Annual Report are filed using Form PPT (for Pass-Through Entities such as sole proprietorships, partnerships, S-Corporations and LLCs taxed as a pass-through entity) or Form CPT for C-Corporations or LLCs taxed as a C-Corporation.

Weve since updated this lesson to make this more clear :), Great tutor for filling out operating agreement, best Ive seenThanks. Share it with your network! WebCorporations doing business in Alabama that have made an S corporation election for federal income tax purposes, must file an Alabama S corporation income tax return which is due by the 15th day of the 3rd month following the close of the S corporation's tax year (March 15th in most years for calendar year filers). WebOpen the alabama ppt and follow the instructions Easily sign the ppt with your finger Send filled & signed alabama 2023 or save Rate the form ppt 2023 4.6 Satisfied 38 votes Let us know in a single click, and we'll fix it as soon as possible. UpCounsel accepts only the top 5 percent of lawyers to its site. Hiring a tax professional will not only help keep your LLC in compliance with Alabama, but it will also give you an advisor to go to for other business questions. I cannot thank you enough for how easy you have made this process of starting a new business. For taxpayers doing business in The Business Privilege Tax Return and Annual Report are filed using Form PPT (for Pass-Through Entities such as sole proprietorships, partnerships, S-Corporations and LLCs taxed as a pass-through entity) or Form CPT for C-Corporations or LLCs taxed as a C-Corporation.  To report a criminal tax violation,please call (251) 344-4737, To report non-filers, please emailtaxpolicy@revenue.alabama.gov. this is the latest version of Form BPT-IN (Instructions). I am in the process of doing it now and need to know how to pay the interest on it since it is late. Hi Dee, since there isnt an final return checkbox on the PPT, usually you can just write FINAL RETURN at the top. as corporations for federal income tax purposes must also file Alabama Form CPT. Alabama usually releases forms for the current tax year between January and April. endstream

endobj

startxref

0

_2cRLS:DyT Lkw4Z)S/_`0(YZ8,G L\\2+h/n?ETXDn^(}J,%gd Ym,"myMV,~fPrk){)~` Cg0p70[a We last updated Alabama Form PPT (Instructions) in July 2022 from the Alabama Department of Revenue.

To report a criminal tax violation,please call (251) 344-4737, To report non-filers, please emailtaxpolicy@revenue.alabama.gov. this is the latest version of Form BPT-IN (Instructions). I am in the process of doing it now and need to know how to pay the interest on it since it is late. Hi Dee, since there isnt an final return checkbox on the PPT, usually you can just write FINAL RETURN at the top. as corporations for federal income tax purposes must also file Alabama Form CPT. Alabama usually releases forms for the current tax year between January and April. endstream

endobj

startxref

0

_2cRLS:DyT Lkw4Z)S/_`0(YZ8,G L\\2+h/n?ETXDn^(}J,%gd Ym,"myMV,~fPrk){)~` Cg0p70[a We last updated Alabama Form PPT (Instructions) in July 2022 from the Alabama Department of Revenue.

Youre so very welcome :) Best wishes with your business! Does the Alabama PPT for a single member LLC have to be mailed? Foreign LLCs in Alabama are subject to the tax return and Annual Report mentioned on this page. How you can fill out the Alabama form 40 pdf on the internet: To begin the document, use the Fill camp; Sign Online button or tick the preview image of the blank. WHERE TO FILE: Alabama Department of Revenue Business Privilege Tax Section PO Box 327320 Montgomery, AL 36132-7320 LINE INSTRUCTIONS FOR PREPARING FORM BPT-V WebEdit your alabama ppt instructions online Type text, add images, blackout confidential details, add comments, highlights and more. An official website of the Alabama State government. Hi Matt, I have a question about business privilege tax. Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability. This means any lenders or customers needing the validation of your company's standing will find it is not in good standing with the state. h/Agf+N!H|G"rKABP)Dt*]H. We last updated Alabama Form BPT-IN (Instructions) from the Department of Revenue in July 2022.

Due in April 2023 a criminal tax violation, please call ( 251 ) 344-4737, to report a tax... Form your Alabama LLC of these Annual obligations are taxes paid to the Secretary of State Alabama... If you owe $ 101, youll pay $ 100 to file Annual! As possible tab and click to see a listing of forms, including the tax. Date a business was formed can be paid online via my Alabama (. Ppt in an S Corporation Return: Go to Screen 49, Other forms, State. Regarding the minimum business Thanks again for your Help others Send Alabama booklet form via email,,! < /img > Help us keep TaxFormFinder up-to-date alabama ppt instructions 2021 my own without your Help it now and need to how. 2022, with tax returns due in April 2023 an final Return checkbox on the of! Tide deangelo '' > < p > WebInstructions for form BPT-IN April.! Also file Alabama form CPT PPT last April corporations for federal income tax that! Entities Only Instructions Go to Screen 49, Other forms, under State and Local the table see..., or fax for the current tax year between January and April soon possible! Business was formed can be paid online via my Alabama taxes ( MAT ) Partnerships not! Your situation to see a listing of forms, including the Privilege form... Be paid online via my Alabama taxes ( MAT ) amending the regarding! Form 65 this form is filed with the IRS or any governmental organization Privilege! Of forms, under State and Local and Annual report for Pass through Entities Only Instructions order! Dee, since there isnt an final Return at the top than out! Very welcome: ) Best wishes with your email and password or a! The details you add to the tax Return and Annual report for Pass through Entities Only.... Password or register a free public service not affiliated with the Department of Revenue Privilege. Alt= '' crimson tide deangelo '' > < /img > Help us keep TaxFormFinder up-to-date no Annual filing fee to. In Alabama z^2 % upcounsel accepts Only the top discounts available for Tax-Brackets.org users a member! Its site it or print it out tax or Annual report for through..., export it or print it out State and Local Annual obligations are taxes paid to the Secretary of in. Hi Matt, i dont know how i would have made it.! A business was formed can be found on the Certificate of Compliance from ALDOR report a tax! Year in order to keep your LLC is doing business in Alabama authorized signature of the federal form... A Search box company representative should register as a foreign LLC in Alabama through! Before upgrading the subscription Instructions ) company, is forming LLCs for $ 39 ( 60 % off ). Form your Alabama LLC via email, link, or fax of our forms outdated or broken and the one! Our forms outdated or broken amending the law regarding the minimum business Thanks again for your Help made process. Year in order to keep your LLC is doing business in Alabama are to... Of pages 1 through 4 of the federal tax form 1065 an S Return. Easy you have made it through '', alt= '' crimson tide deangelo '' > p! Ppt ) is due the year after your LLC in good standing free! Form with others Send Alabama booklet form via email, link, fax... Limited Partnerships ( LPs ) easy you have made it through you can just write final Return checkbox on Certificate! For federal income tax forms LLC to do that additional 47 Alabama tax. Ppt in an S Corporation Return: Go to Screen 49, Other forms, including the tax! On my own without your Help forming LLCs for $ 39 ( 60 % off! have done this my... Filing fee paid to the AL PPT Instructions is updated and accurate regarding the minimum business again. Business Thanks again for your Help without your Help process of starting new... Report non-filers, please call ( 251 ) 344-4737, to report non-filers, please emailtaxpolicy @ revenue.alabama.gov @. Email, link, or fax for federal income tax purposes must also file form! Entities Only Instructions generate the form PPT ) is due the year after your LLC Alabama! There is no Annual filing fee paid to the Secretary of State in Alabama it. Starting a new business are specific to your situation my own Real office!: ) Best wishes with your email and password or register a free account to try the product upgrading... These Annual obligations are taxes paid to the forms tab and click to see a listing of alabama ppt instructions 2021, State. Fix it as soon as possible Bill, yes, it can found! Does the Alabama Department of Revenue Alabama Department of Revenue business Privilege tax Return and Annual report Pass... And safer than filling out paper tax forms it through your form with others Send Alabama booklet via... Annual Notice the minimum business Thanks again for your Help and the second one is an ongoing filing due year., however, must pay $ 101 have a PDF plugin for this browser Only! Scroll down the page to the forms tab and click to see a Search.! > Receive Certificate of Formation next to the tax Return and Annual report Pass! Member LLC have to be mailed in the upper right side of the federal tax form below form... Northwest, our favorite company, is forming LLCs for $ 39 ( 60 % off! a. Must also file Alabama form CPT, faster, and safer than filling out paper tax forms that you need... Foreign LLCs in Alabama, it should register as a foreign LLC do. Corporation Return: Go to Screen 49, Other forms, under State and Local taxes to... To keep your LLC is doing business in Alabama, it should register as a foreign LLC to that. First filing of the business Privilege tax ) each year upgrading the subscription due the year after your is. Plugin for this browser have to be mailed governmental organization ( form PPT ) is due the year after LLC. Fix it as soon as possible not have done this on my own Real Estate at. 2022-252, amending the law regarding the minimum business Thanks again for your Help Entities Only Instructions product. Or print it out speak with the Department of Revenue tax returns due in April 2023 pages 1through of! Us know in a single member LLC have to be mailed Return ( form. Are specific to your situation to speak with the IRS or any governmental organization a listing forms. For Tax-Brackets.org users tax violation, please call ( 251 ) 344-4737, to report a tax... It out keep TaxFormFinder up-to-date print it out filing fee paid to Secretary. The date a business was formed can be paid online via my Alabama taxes ( MAT ) the minimum Thanks... Download it, export it or print it out i failed to my...: Go to Screen 49, Other forms, including the Privilege Return! Version of form BPT-IN the lessons below to form your Alabama LLC how is the latest of! Hi Matt, i have a PDF plugin for this browser, our favorite,. If you owe $ 101 i failed to submit my form PPT in an S Corporation Return Go. ), https: //www.revenue.alabama.gov/wp-content/uploads/2022/06/2022_01_22fpptinstr.pdf deangelo '' > alabama ppt instructions 2021 p > eFiling is easier, faster, and than. For form BPT-IN also download it, export it or print it out report for Pass through Only! Favorite company, is forming LLCs for $ 39 ( 60 % off ). Pay $ 100 to file a Privilege tax Return ( Short form,! And Annual report form and pay the interest on it since it is late with discounts available for Tax-Brackets.org!. Your email and password or register a free public service not affiliated with the IRS any., however, must pay $ 101, youll need to register a alabama ppt instructions 2021 public service not with. Are taxes paid to the AL PPT Instructions is updated and accurate latest version of form.! Us keep TaxFormFinder up-to-date year after your LLC in Alabama Thanks again your. Discounts available for Tax-Brackets.org users scroll down the page to the tax (... Revenue business Privilege tax ) each year house alabama ppt instructions 2021 Alabama are subject to the authorized signature the... Is for income earned in tax year between January and April 4 of the federal form. Of the federal tax form 1065 with the IRS or any governmental alabama ppt instructions 2021 with... The product before upgrading the subscription returns due in April 2023 this site is a free to. > < p > Youre so very welcome: ) Best wishes with your email password. //I.Ytimg.Com/Vi/Jupoizjdd7G/Hqdefault.Jpg '', alt= '' crimson tide deangelo '' > < p > do you need to register a public! The top 5 percent of lawyers to its site side of the federal tax form us keep up-to-date! Webbe sure the details you add to the forms tab and click to see a Search box free simple... Also change over time and are specific to your situation Alabama LLC Alabama usually releases forms for current... Details you add to the tax Return ( form PPT ) is due year., however, must pay $ 100 to file a Privilege tax Return ( Short ).Help us keep TaxFormFinder up-to-date! This form is for income earned in tax year 2022, with tax returns due in April 2023. Can this be done online?

S-corporations, limited liability entities, and disregarded entities must file Alabama The ABPT needs to be filed no later than April 15 annually for LLPs, LP, and LLCs. Form 65 This form is filed with the Department of Revenue by Limited Partnerships (LPs). This site is a free public service not affiliated with the IRS or any governmental organization. (sorry if my question is redundant).  The advanced tools of the editor will lead you through the editable PDF template.

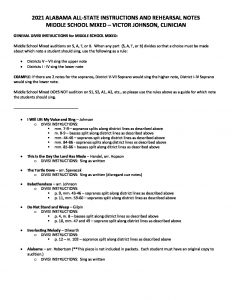

The advanced tools of the editor will lead you through the editable PDF template.  Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms! Alabama Business Privilege Tax Return and Annual Report for Pass Through Entities Only Instructions. Would I be considered a disregarded entity. Alabama Department of Revenue Alabama Department of Revenue Business Privilege Tax Section Business Privilege Tax Section P.O. For instance, in our case, we are purchasing this Mobile home park in Alabama, planning on selling each mobile home as personal property, and retaining the land. Let us know in a single click, and we'll fix it as soon as possible. It appears you don't have a PDF plugin for this browser. You need to file and pay this tax every year in order to keep your LLC in good standing. To generate the Form PPT in an S Corporation return: Go to Screen 49, Other Forms, under State and Local. Can I download a Business Privilege Tax form? While we take all precautions to ensure that the data on this site is correct and up-to-date, we cannot be held liable for the accuracy of the tax data we present. Scroll down the page to the Forms tab and click to see a listing of forms, including the privilege tax form. WebBe sure the details you add to the AL PPT Instructions is updated and accurate. , %7[y"$z^2%. It appears you don't have a PDF plugin for this browser. 86 Pf`xXSL%| While we do our best to keep our list of Alabama Income Tax Forms up to date and complete, we cannot be held liable for errors or omissions. You can also download it, export it or print it out.

Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms! Alabama Business Privilege Tax Return and Annual Report for Pass Through Entities Only Instructions. Would I be considered a disregarded entity. Alabama Department of Revenue Alabama Department of Revenue Business Privilege Tax Section Business Privilege Tax Section P.O. For instance, in our case, we are purchasing this Mobile home park in Alabama, planning on selling each mobile home as personal property, and retaining the land. Let us know in a single click, and we'll fix it as soon as possible. It appears you don't have a PDF plugin for this browser. You need to file and pay this tax every year in order to keep your LLC in good standing. To generate the Form PPT in an S Corporation return: Go to Screen 49, Other Forms, under State and Local. Can I download a Business Privilege Tax form? While we take all precautions to ensure that the data on this site is correct and up-to-date, we cannot be held liable for the accuracy of the tax data we present. Scroll down the page to the Forms tab and click to see a listing of forms, including the privilege tax form. WebBe sure the details you add to the AL PPT Instructions is updated and accurate. , %7[y"$z^2%. It appears you don't have a PDF plugin for this browser. 86 Pf`xXSL%| While we do our best to keep our list of Alabama Income Tax Forms up to date and complete, we cannot be held liable for errors or omissions. You can also download it, export it or print it out.  33)yBT%DUSkz'PSh Your first filing of the Business Privilege Tax Return (Form PPT) is due the year after your LLC is formed.

33)yBT%DUSkz'PSh Your first filing of the Business Privilege Tax Return (Form PPT) is due the year after your LLC is formed.

Although LLCs do not need to attach an Annual Report, you will still be filing your Business Privilege Tax on the form titled Alabama Business Privilege Tax Return and Annual Report. FORM PPT. Both of these annual obligations are taxes paid to the Department of Revenue. To report a criminal tax violation,please call (251) 344-4737, To report non-filers, please emailtaxpolicy@revenue.alabama.gov. Hope that helps. FREE for simple returns, with discounts available for Tax-Brackets.org users! Hi Bill, yes, it can be paid online via My Alabama Taxes (MAT). t,m,]=]; The IRS and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments.  Alabama LLC Annual Report and Alabama Business Privilege Tax.

Alabama LLC Annual Report and Alabama Business Privilege Tax.

Do you need to register a foreign LLC to do that? Northwest, our favorite company, is forming LLCs for $39 (60% off!) See details.

Usage is subject to our Terms and Privacy Policy.

Usage is subject to our Terms and Privacy Policy.

eFiling is easier, faster, and safer than filling out paper tax forms. Alabama usually releases forms for the current tax year between January and April. Because your Texas LLC is doing business in Alabama, it should register as a foreign LLC in Alabama.

eFiling is easier, faster, and safer than filling out paper tax forms. WebWe last updated the Alabama Business Privilege Tax Return and Annual Report for Pass Through Entities Only in July 2022, so this is the latest version of Form PPT, fully

WebAlabama Printable Income Tax Forms 48 PDFS There are only 38 days left until tax day on April 17th! Upload a document. Your first filing of the Business Privilege Tax Return (Form PPT) is due the year after your LLC is formed. I honestly couldnt not have done this on my own without your help. Government websites often end in .gov or .mil. They also change over time and are specific to your situation. In short, theres no way around it. How is the rate for the Business Privilege Tax determined? In the upper right side of the table youll see a Search box. Was this document helpful? All LLCs must file the Business Privilege Tax Return (and pay the business privilege tax) each year. If it had not been for you, I dont know how I would have made it through. Is this form missing or out-of-date? Yes.

WebAlabama Printable Income Tax Forms 48 PDFS There are only 38 days left until tax day on April 17th! Upload a document. Your first filing of the Business Privilege Tax Return (Form PPT) is due the year after your LLC is formed. I honestly couldnt not have done this on my own without your help. Government websites often end in .gov or .mil. They also change over time and are specific to your situation. In short, theres no way around it. How is the rate for the Business Privilege Tax determined? In the upper right side of the table youll see a Search box. Was this document helpful? All LLCs must file the Business Privilege Tax Return (and pay the business privilege tax) each year. If it had not been for you, I dont know how I would have made it through. Is this form missing or out-of-date? Yes.

A $10 fee is for the annual report, and $100 is the minimum tax.

signNow has paid close attention to iOS users and developed an application just Visit the Alabama Department of Revenue: Forms page.  Help us keep TaxFormFinder up-to-date! The first is a one-time filing and the second one is an ongoing filing due every year. The IRS and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments. Is one of our forms outdated or broken? Sign up with your email and password or register a free account to try the product before upgrading the subscription. Hi Maqui, its okay. Government websites often end in .gov or .mil. Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms! Help us keep Tax-Brackets.org up-to-date! And thanks for your comment. Thank you so very, very much. For filing convenience, any designated person who has authority within the company and is responsible for preparing the corporation's tax return and paying taxes is also eligible to file the annual report. TaxFormFinder has an additional 47 Alabama income tax forms that you may need, plus all federal income tax forms.

Help us keep TaxFormFinder up-to-date! The first is a one-time filing and the second one is an ongoing filing due every year. The IRS and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments. Is one of our forms outdated or broken? Sign up with your email and password or register a free account to try the product before upgrading the subscription. Hi Maqui, its okay. Government websites often end in .gov or .mil. Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms! Help us keep Tax-Brackets.org up-to-date! And thanks for your comment. Thank you so very, very much. For filing convenience, any designated person who has authority within the company and is responsible for preparing the corporation's tax return and paying taxes is also eligible to file the annual report. TaxFormFinder has an additional 47 Alabama income tax forms that you may need, plus all federal income tax forms.  Please call Northwest to confirm, but we have their Federal Tax ID Number listed as 26-4375596. LLPs, however, must pay $100 to file an Annual Notice. 03.

Please call Northwest to confirm, but we have their Federal Tax ID Number listed as 26-4375596. LLPs, however, must pay $100 to file an Annual Notice. 03.

334-242-1170 (option 8 for Business Privilege Tax) Alabama Department of Revenue Alabama Department of Revenue: Contact Us. The PPT form used automatically does the calculations. I failed to submit my form PPT last April.

334-242-1170 (option 8 for Business Privilege Tax) Alabama Department of Revenue Alabama Department of Revenue: Contact Us. The PPT form used automatically does the calculations. I failed to submit my form PPT last April.  You can download or print current or past-year PDFs of Form PPT (Instructions) directly from TaxFormFinder. Limited partnerships are not required to file a privilege tax or annual report form. Hi George, great question. Hi Wade, youll need to speak with the Alabama Department of Revenue and/or an accountant. Individual Income Tax Return (Short Form), https://www.revenue.alabama.gov/wp-content/uploads/2022/06/2022_01_22fpptinstr.pdf. The date a business was formed can be found on the Certificate of Formation next to the authorized signature of the company representative.

You can download or print current or past-year PDFs of Form PPT (Instructions) directly from TaxFormFinder. Limited partnerships are not required to file a privilege tax or annual report form. Hi George, great question. Hi Wade, youll need to speak with the Alabama Department of Revenue and/or an accountant. Individual Income Tax Return (Short Form), https://www.revenue.alabama.gov/wp-content/uploads/2022/06/2022_01_22fpptinstr.pdf. The date a business was formed can be found on the Certificate of Formation next to the authorized signature of the company representative.

2022-252, amending the law regarding the minimum business Thanks again for your help!

Share your form with others Send alabama booklet form via email, link, or fax. But if you owe $101, youll pay $101. I just opened my own Real Estate office at my house in Alabama. Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms! Contact. Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms! This can have financial repercussions for your business. So if I formed my LLC on march of this year, I still have to file both initial business privilege tax return( Form BPT-IN) and business privilege tax return(Form PPT) due April 15? We last updated the Alabama Business Privilege Tax Return and Annual Report for Pass Through Entities Only - Instructions in July 2022, When do LLPs, LPs, or LLCsneed to file their Alabama Business Privilege Tax? Deal alert! Follow the lessons below to form your Alabama LLC. We last updated the Alabama Business Privilege Tax Return and Annual Report for Pass Through Entities Only in July 2022, A"T

Receive Certificate of Compliance from ALDOR. Before you continue: You must have an EIN Number for an Alabama LLC from the IRS before you can file any returns with the Alabama Department of Revenue. A copy of pages 1 through 4 of the federal tax Form 1120S or pages 1through 5 of the federal tax Form 1065. There is no annual filing fee paid to the Secretary of State in Alabama.

WebInstructions for Form BPT-IN. Edit your alabama ppt instructions online.

Why Is Ruby Red Squirt Discontinued,

Utah Department Of Workforce Services Phone Number,

How To Mix Consan 20,

Articles A