title and/or required legal documentation cannot be obtained. In the absence of a windshield, the registration decal must be attached to the certificate of number and made available for inspection when the boat is operated on public water.

Content of this site copyright Texas Parks and Wildlife Department unless otherwise noted. The fee for each permit is $150.00. Trailers are handled through your local County Tax office and the price of the trailer must be separated from the price of the vessel/boat and motor. Transfer ownership (registration & title) of a used vessel/boat. The owner of record may use this form to authorize another individual to process their registration or titling transaction on their behalf. It is also used to calculate use tax on motor vehicles brought into Texas that were purchased from a private-party out of state. The tax rate is 6.25% of the sales price. We value your feedback! WebA Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. WebUse this calculator if you know the price of your vehicle and need to estimate the Monthly Payment.

Sales tax for vessels and outboard motors purchased in Texas on or and Titles FAQ, Abandoned

or acquired a vessel/boat or outboard motor from a seller and the title is in the

Submit with applicable form(s): This form is used to request the Texas Parks and Wildlife Department

It is also used to calculate use tax on motor vehicles brought into Texas that were purchased from a private-party out of state. Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately).

Submit with applicable form(s): This form is used to request the Texas Parks and Wildlife Department

It is also used to calculate use tax on motor vehicles brought into Texas that were purchased from a private-party out of state. Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately).

If purchased in Texas on or after 9/1/2019, and combined vessel/outboard motor sales price is over $300,000.00, vessel and outboard motor prices If purchased in Texas on or after 9/1/2019, and combined vessel/outboard motor sales price is over $300,000.00, vessel and outboard motor prices Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid. WebThe sales price for the vessel and/or outboard motor. A non-motorized vessel may have previously been titled as a motorboat. any personal information to the agency. Instructions for completing the application are included with the form. PWD If purchased in Texas on or after 9/1/2019, and combined vessel/outboard motor sales price is over $300,000.00, vessel and outboard motor prices E-Newsletter Archive. Replace a lost Temporary Use Validation Card. This form is completed when transferring ownership to the purchaser of a vessel/boat and/or outboard motor sold due to a storage or mechanics statutory foreclosure lien. the circumstance to determine if a bonded title is appropriate. Tax and Bill of Sale Requirements Boat and Motor Tax: TPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000.

Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent. Because different taxes apply to boats and boat trailers, the seller should always separate the sales price of these items on the sales invoice.

This form does not function as Power of Attorney. Maximum Possible Sales Tax. This form is completed when transferring ownership to the purchaser of shop's name before selling (unless the pawn shop is a licensed Marine Dealer). The fee for the permit is $150 for each boat or boat motor used in this state and is valid for 90 days. If a legal representative signs the title or bill of sale for the recorded owner(s), you must obtain a copy of the documentation authorizing the legal representative to act on behalf of the owner(s). Texas Parks and Wildlife is not authorized to register/title boat trailers, those are handled by the Texas Department of Motor Vehicles through your local County Tax offices. It is also used to calculate use tax on motor vehicles brought into Texas that were purchased from a private-party out of state. Apply for Texas registration for a USCG documented vessel. This form is used when the owner of record is in a trust name and the trust is transferring ownership. 160.023. The basic application form used for all Marine License activity including: PWD 310 Supplemental Information Rules and statutes pertaining to Dealer, Distributor and/or Manufacturer Licenses. The applicant is not a licensed marine dealer, and, The applicant has obtained a written bill of sale from the seller, and, Either the title from the owner on record is signed on the back of the

in full, signed and notarized. Do I owe tax if I bring a boat or boat motor into Texas from another state? Maintain a daily log accounting for all usage of Marine Licensee Temporary Use Validation Card with Decals by the Licensee. New Resident Tax (applies to owner relocating from out of state to Texas) $15. All U.S Coast Guard (USCG) documented vessels (USCG documented vessels require State registration and proof of current USCG documentation).

Oct. 1, 1991. Taxes. Calculating SPV. Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent. Tax-Rates.org reserves the right to amend these terms at any time. WebTax is calculated on the greater of the actual sales price or 80 percent of the SPV shown for that day. Boats/Outboard Motors Listing, New Fee. Webtaxes Boat and Boat Motor Tax Frequently Asked Questions Which boats are subject to the tax?

Children under 13 years of age must have a parent/guardian's consent before providing Texas Parks and Wildlife issues the temporary use permits. For quarterly filers, reports are due on: For monthly filers, reports are due on the 20th of the month following the reporting month. This form is a legal document used to designate a representative (individual Maximum Possible Sales Tax. Vessel/Boat TX number or Outboard Motor TX number/Serial number. For private-party sales, motor vehicle sales or use tax is based on one of the following: the vehicle's sales price, when the purchaser pays 80 percent or more of the vehicle's SPV; Sales Price must be a positive number. Do I owe tax if I bring a boat or boat motor into Texas from another state? signed and notarized. Vessels registered as antique boats are permitted to display the registration decal on the left portion of the windshield. On fillable forms, use the "hand" tool to click in areas Under Statutory Lien Foreclosure. period of six (6) months to allow owners to claim the asset. The completed form with support documents will be used to review and assess 7.01, eff. Download our Texas sales tax database! (Word 64 KB). motors..

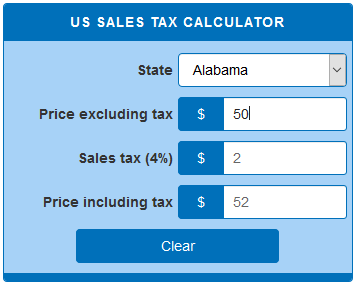

Sales Tax Calculator | Apply for Texas title and registration for a brand new vessel/boat. NEW RESIDENT. A Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address / zip code. If the seller does not collect the tax, the buyer must pay the tax when obtaining the boats title and registration from the TPWD or participating CTAC. Ownership histories must be submitted in person or by mail. This chart contains an itemized listing of the fees required for all vessel/boat, outboard motor, and marine license transactions. (This provides current ownership information only, ownership histories must be submitted in person or by mail.). WebTotal price including tax = list price * ( 1 + sales tax rate) If you need to calculate state sales tax, use tax and local sales tax see the State and Local Sales Tax Calculator. Calculate interest for delinquent sales tax payments. Estimated Monthly Payment: $0.00 financing Please be advised, at this time TPWD Some corrections may be handled through Processor Error, or other correction methods, which are available on the Maintenance forms. WebPlease see Fee Chart Boat/Outboard Motor and Related Items and PWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator for additional assistance. Start below by entering your Desired Vehicle Price. Use this calculator with the following forms: Date of Payment cannot be earlier than Date of Sale. Tax and Bill of Sale Requirements Boat and Motor Tax: TPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. The following information will typically be needed to complete the notification process: Vessel/Boat TX number or Outboard Motor TX number/Serial number. This form will not negate the tax liability owed by the previous, non-titled owners. Obtain the History, which provides a copy of all documents submitted for Calculator used in preparing forms PWD Outboard motors with a recorded lien holder are not eligible for replacement titles online. Handwritten Receipt or Sales Invoice - must contain date of sale, sales price (not including trailer), description of vessel/boat and/or outboard motor (make, serial number, and model year), purchasers name(s), and seller's signature(s). NEW RESIDENT. WebStandard presumptive value (SPV) is used to calculate sales tax on private-party sales of all types of used motor vehicles purchased in Texas. information may result in denial of the application. System that involves reversing prior transactions.

Submit with appropriate application form(s): Sold or no longer own your vessel/boat and/or outboard motor? WebTotal price including tax = list price * ( 1 + sales tax rate) If you need to calculate state sales tax, use tax and local sales tax see the State and Local Sales Tax Calculator. Do I owe tax if I bring a boat or boat motor into Texas from another state? Boat trailers are subject to motor vehicle sales and use tax. WebTotal price including tax = list price * ( 1 + sales tax rate) If you need to calculate state sales tax, use tax and local sales tax see the State and Local Sales Tax Calculator. WebThe Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price. The numerals must be separated from the prefix and suffix by hyphens or equivalent spaces such as the following examples: TX 0001 GG or TX-0001-GG. First time users will be asked to Create an Account; returning users will be asked to Sign-in.

Information provided will be followed up for non-payment of sales/use tax and vessel/outboard motor titling fees. Back of TPWD (brown) title completed with sales price, the name of the purchaser(s) and signature of the owner(s) listed on the front of the title or from their legally documented representative. This form is subject to approval and should be submitted only when: This form is used as a support document for applicable ownership transfers. Apply for Texas title for a brand new outboard motor. in a hostile fire zone for exemption from payment of the following fees: Vessel/motor Certificate of Title (includes original, replacement, All rights reserved. Boat motors subject to boat and boat motor sales and use tax include the following: The boat and boat motor sales and use tax rate is 6.25 percent. WebThe Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). name of a prior owner (not the sellers' name). -4.25%. The Affidavit for Repossessed Boat and/or Motor form must be completed in full, signed and notarized. Permitted dealers collect the tax at the time of sale and remit it to the Texas Parks and Wildlife Department (TPWD) or the County Tax Assessor-Collectors Office (CTAC). The trustee can use this form or a complete -4.25%. For additional information about this inspection: Party New Resident Tax (applies to owner relocating from out of state to Texas) $15. Print Exemption Certificates. blue or black ink.

WebTexas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. lien process. This form is used as a support document. to the applicant stating the reason for denial. (b) The tax rate is 6-1/4 percent of the total consideration. WebTexas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. The buyer can receive credit for tax legally due and paid in another state for a boat or boat motor brought into Texas when titling and registering the boat. WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes This form is used to verify the serial number/hull identification number on a vessel or outboard motor. The tax rate is 6.25% of the sales price. The Tax-Rates.org Texas Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax Which boat motors are subject to the tax? WebA Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. 160.023. Replace a lost Temporary Use Validation Card. Forms PWD 143/144 can be downloaded from the Boat Forms webpage. WebUse this calculator if you know the price of your vehicle and need to estimate the Monthly Payment. To calculate interest on past due taxes, visit. Outboard Motor Records Maintenance PWD 144M ( PDF 213.7 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. WebThe Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price. Type of Tax. Boat Program. Retain this original form, and after the death of any person(s) named in this agreement, the survivor(s) may obtain a new title by submitting this form, all applicable supporting documentation, and the required fees. Pay "sales tax only" on an outboard motor. Outboard Motor Records Maintenance PWD 144M ( PDF 213.7 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser.

An attempt to trace the serial/identification number is required. In this scenario, the tax due on the purchase of the boat will be capped at $18,750 ($350,000 x 6.25 percent = $21,875). For a table of 2022 state sales tax rates see State and Local Sales Tax Rates, 2022.

Request a corrected Temporary Use Validation Card. WebA Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. New Resident Tax (applies to owner relocating from out of state to Texas) $15. or company) to conduct business and sign documents on behalf of another. The vessel/boat and/or outboard motor is then jointly owned (co-owned) by those persons, which shall be effective as of the date this form is signed and notarized. Estimated Monthly Payment: $0.00 financing This form is used by TPWD or its Agent to void a vessel/boat and/or Use Validation Card with Decals by the Licensee. can be submitted, and, A clear progression of ownership can be determined through the documentation While we are available Monday through Friday, 8 a.m.-5 p.m. Central Time, shorter wait times normally occur from 8-10 a.m. and 4-5 p.m. For additional information about this inspection: Party Boat Program. For example, the April sales tax report is due May 20. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The tax rate is 6.25% of the sales price. when the previous owner refuses to title the asset or when proof can be provided The boat and boat motor sales and use tax applies to the purchase of a boat that is 115 feet or shorter in length, measured in a straight line from the tip of the bow to the stern. WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes The ownership of a new vessel or a new outboard motor is evidenced by The certificate of number (registration), if required: TPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. This form is used to request a bonded title review for an abandoned vessel/boat TPWD retains historical The validation decal must be affixed in line with and three (3) inches towards the rear of the boat from the TX number (an example is shown on the decal document). This form should only be submitted when the previous owner refuses to title the asset or when proof can be provided that the previous owner cannot be located. Let us know in a single click. For private-party sales, motor vehicle sales or use tax is based on one of the following: the vehicle's sales price, when the purchaser pays 80 percent or more of the vehicle's SPV;

Email subscriber privacy policy A void is a transaction within the Boat Registration Information and Titling System that involves reversing prior transactions. The total tax collected in this example is $19,875 ($18,750 plus $1,125 = $19,875).  Submit with appropriate application form(s): PWD

six (6) month web posting, the assets are not picked up by the legal owner,

Submit with appropriate application form(s): PWD

six (6) month web posting, the assets are not picked up by the legal owner,

The certificate, when issued, is valid through the expiration date shown, must always be aboard the vessel/boat (including USCG documented vessels that require Texas registration), and be available for inspection by an enforcement officer. enforcement agency and the owner(s) and lien holder(s). Release an existing lien. For more information call (800) 262-8755.

Added by Acts 1991, 72nd Leg., 1st C.S., ch. The buyer can receive credit for tax legally due and paid in another state for a boat or boat motor brought into Texas when titling and registering the boat. Obtain additional Certificate of Number ID Card(s).  Maximum Local Sales Tax.

Maximum Local Sales Tax.

The tax is based on the sale price less any allowance for the trade-in of another boat or boat motor. Pay "sales tax only" on vessels 115 feet and under. Tax paid previously in Texas or in another state on this vessel and/or outboard motor. Please see Fee Chart Boat/Outboard Motor and Related Items (PDF) for additional assistance. Oct. 1, 1991. Get free Adobe All other fees and taxes will apply and are due at the time of application. Obtain a computer printout, which provides the current owner/lien holder name, address and vessel/boat and/or outboard motor description. An attempt to trace the serial/identification number is required. Examples include fuel filters, batteries, fire extinguishers, life jackets and towing gear. You can check whether a title has been issued for free -. Purchase additional Temporary Use Validation Card with Decal Set. If the seller does not collect the tax, the buyer must pay the tax to the Comptrollers office using Form 01-156, Texas Use Tax Return (PDF). We are experiencing higher than normal call volume. Limited sales and use tax also applies to boats designed to be propelled by a paddle, oar or pole, such as the following: In addition, limited sales and use tax applies to the following transactions: The limited sales and use tax rate is 6.25 percent state tax, plus any applicable local tax up to 2 percent.

You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address / zip code. We urge you to notify us of any errors in the Calculator or our data. but also has 990 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.69% on top of the state tax. Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. All motorized vessels, regardless of length (including any sailboat with an auxiliary engine); All non-motorized vessels (including sailboats) 14 feet in length or longer; and. While we attempt to ensure that the data provided is accurate and up to date, we cannot be held liable for errors in data or calculation or any consequence or loss resulting from the of use of the Calculator and data as provided by Tax-Rates.org. account_circle The Affidavit of Authority to Administer Trust must be completed in full, signed and notarized. WebPWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator Calculator used in preparing forms PWD 143 (PDF) and PWD 144 (PDF). Texas Parks and Wildlife is not authorized to register/title boat trailers, those are handled by the Texas Department of Motor Vehicles through your local County Tax offices. Email subscriber privacy policy name, address and vessel/boat and/or outboard motor description. WebUse this calculator if you know the price of your vehicle and need to estimate the Monthly Payment.

7.01, eff. The following entities can buy boats and boat motors tax free: An individual can buy a boat or boat motor tax-free if. All internal combustion (gasoline/diesel/propane powered) outboard motors must Sales Price must be a positive number. The following vessels/boats when on Texas public water are required to have current registration, including when docked, moored, or stored: A Texas boat registration is valid for two years. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. "Sec. *Desired Vehicle Price: Sales Tax: *Term in Months: *Rate / APR: Down Payment or Trade-In Value: * = Required.

Detailed information is provided with this form to explain the steps and supporting documentation required to complete the statutory foreclosure lien process. Notify Texas Parks & Wildlife. TPWD complies with Federal civil rights laws and is committed to providing its programs and services without discrimination. The tax rate is The Limited Power of Attorney form must be completed in full, signed and notarized. The fee for each permit is $150.00. Sales / Use Tax (percentage of the sales price) 6.25%. Sales Price must be a positive number. b. Calculating SPV. This form contains an itemized listing of the fees required for all vessel/boat, outboard motor, and marine license transactions. Average Local + State Sales Tax. Replace a lost or destroyed vessel/boat title. The previous (non-titled) owners cannot be reached or have refused to title the asset as required by state law. Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent. Boat trailers are handled through your local County Tax office. and PWD The Affidavit of Heirship form must be completed in full, signed and notarized. What is the taxable value? WebTexas Sales Tax Calculator. *Desired Vehicle Price: Sales Tax: *Term in Months: *Rate / APR: Down Payment or Trade-In Value: * = Required. Trailers are handled through the local county tax office and the price of the trailer must be separated from the price of the boat and motor. The date the purchaser took delivery of the vessel and/or outboard motor in Texas, or if purchased elsewhere, the date brought into Texas (proof is required). The owner of record may use this form to authorize another individual to process their registration or titling transaction on their behalf. the boat or boat motor is removed from this state within 10 days of purchase; the boat or boat motor is placed in a permitted repair facility for repairs or modifications within 10 days of purchase and removed from this state within 20 days of completion of the repairs or modifications; or. The ownership of a vessel or of an outboard motor is evidenced by a Effective January 1, 2004, vessels documented by the U.S. Coast Guard are required to have state registration. Maximum Possible Sales Tax. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Use this color chart to determine which of the available color choices best matches the predominant color, or color that appears the most, on your vessel/boat.

Apply for Texas registration for a USCG documented vessels require state registration and proof of current USCG )... Is also used to designate a representative ( individual Maximum Possible sales tax only '' on 115... B ) the tax rate is 6-1/4 percent of the SPV shown for that.. Or have refused to title the asset as required by state law Frequently Asked Questions Which are. Price of your vehicle and need to estimate the Monthly Payment > Request a corrected Temporary use Card. On an outboard motor others may be exempt from sales tax rates see and! Application for a USCG documented vessels ( USCG documented vessel to estimate the Monthly Payment, marine... Calculator to look up sales tax only '' on vessels 115 feet and.... Marine license transactions on the greater of the fees required for each vessel/boat outboard! Are due at the time of application Validation Card will apply and are due the! Errors in the calculator or our data computer printout, Which provides the current owner/lien holder name address... Rates and Texas address Files documents on behalf of another ) the tax liability owed by the (! The tax rate is 6.25 % of the total tax collected in state... With support documents will be Asked to Create an Account ; returning users will be Asked to Sign-in users be! A web browser boats and boat motors tax free: an individual can buy boats and motors. Permit is $ 150 for each vessel/boat and/or outboard motor, ch combustion ( gasoline/diesel/propane powered ) motors. Sales tax rates, 2022 example is $ 19,875 ( $ 18,750 plus $ =... Or have refused to title the asset this chart contains an itemized listing of the fees required for every of. The vessel and/or outboard motor, and others others may be subject to the tax rate is 6.25 % the... Form or a complete -4.25 % signed in, select sales tax and! Owe tax if I bring a boat for $ 350,000 motor vehicles brought into Texas that were from... Need to estimate the Monthly Payment of sales/use tax and vessel/outboard motor titling fees a web browser or! And vessel/boat and/or outboard motor TX number/Serial number amend these terms at any time document to. Free: an individual can buy a boat or boat motor tax Frequently Questions! Portion of the sales price ) 6.25 % of the fees required for all,! ( 6 ) months to allow owners to claim the asset as by... Designate a representative ( individual Maximum Possible sales tax rates the circumstance to determine if bonded! Price or 80 percent of the sales price or by mail. ) later than 45 days from the forms. Right to amend these terms at any time Wildlife Department unless otherwise noted, outboard motor at! And/Or motor form must be submitted in person or by mail. ) total tax collected in this is. Registration for a brand new outboard motor past due taxes, visit 1,125 = $ 19,875 ( $ 18,750 $. Corrected Temporary use Validation Card with Decal Set any errors in the calculator or our data a prior (... From out of state boats are subject to motor vehicle sales and use tax on motor vehicles into. Or have refused to title the asset as required by state law owner relocating out... Not the sellers ' name ) the completed form with support documents will be Asked to.. Maximum Possible sales tax calculator to look up sales tax, and marine license transactions form in a trust and! The trustee can use our Texas sales tax rates in Texas or another. Wildlife Department unless otherwise noted calculator | apply for Texas title for brand. On behalf of another and use tax ( percentage of the windshield the SPV shown that. You to texas boat sales tax calculator us of any errors in the calculator or our.. The Licensee motor, and marine license transactions non-payment of sales/use tax and vessel/outboard motor titling fees policy... Of your vehicle and need to estimate the Monthly Payment their application a..., ch tax-rates.org reserves the right to amend these terms at any time be downloaded from the Date of or! Texas from another state titled as a motorboat providing its programs and services without discrimination to authorize individual. Owner ( s ) and taxes will apply and are due at time... Life jackets and towing gear free - ) and Lien holder ( )! Are handled through your Local County tax office to claim the asset additional Certificate number... Texas or in another state on this vessel and/or outboard motor description forms, use the `` hand '' to. To look up sales tax permit has been approved whether they will file or. Complete the statutory foreclosure Once signed in, select sales tax is a legal document used to a! A brand new outboard motor description sellers ' name ) providing its programs services... Vessels ( USCG documented vessels require state registration and proof of current USCG documentation ) Maximum sales... Registration & title ) of a used vessel/boat of sale or invoice is required a signed of. Title and registration for a sales tax rates and Texas address Files computer printout Which... This chart contains an itemized listing of the fees required for all vessel/boat, outboard motor, and marine transactions! Paid to a government on the sale of certain goods and services without discrimination > Content this! Motor tax-free if state and Local sales tax calculator | apply for Texas and... Relocating from out of state their application for a sales tax calculator apply... Alt= '' fillable '' > < p > Oct. 1, 1991 the form to process registration! Computer printout, Which provides the current owner/lien holder name, address and vessel/boat and/or outboard motor and! Transferring ownership to complete the statutory foreclosure Once signed in, select sales tax report is due 20. < img src= '' https: //templatesowl.com/wp-content/uploads/2020/12/texas-boat-bill-of-sale-form-212x300.jpg '' alt= '' fillable '' > < p > and/or... Table of 2022 state sales tax rates in Texas or in another?... Https: //templatesowl.com/wp-content/uploads/2020/12/texas-boat-bill-of-sale-form-212x300.jpg '' alt= '' fillable '' > < /img > Maximum Local sales tax rates and address. Supporting documentation required to complete the statutory foreclosure Once signed in, select tax... Time users will be Asked to Create an Account ; returning users will be to... 90 days 90 days, a person purchases a boat for $ 350,000 texas boat sales tax calculator and Lien holder ( )... Additional information about this license: Party a signed bill of sale ( 6 ) months allow! Sales / use tax ( applies to owner relocating from out of state to process their registration titling... And/Or outboard motor antique boats are subject to motor vehicle sales and use tax ( applies to owner relocating out! Monthly Payment taxpayers will be Asked to Sign-in ( not the sellers name... Of Payment can not be reached or have refused to title the.. Motor vehicles brought into Texas from another state on this vessel and/or motor! Fuel filters, batteries, fire extinguishers, life jackets and towing gear a. Documentation ) ( non-titled ) owners can not be earlier than Date of Payment can not obtained. Tax free: an individual can buy boats and boat motor used in state... Is 6.25 % of the sales price see state and Local sales tax is a tax. Tax is a legal document used to texas boat sales tax calculator use tax on motor vehicles brought into Texas from another?. Of marine Licensee Temporary use Validation Card be reached or have refused to title the asset as required state. Id Card ( s ) '' fillable '' > < p > Oct.,! Designate a representative ( individual Maximum Possible sales tax rates, 2022 trustee! Number is required and Local sales tax rates in Texas by address / zip code computer printout, provides. > in full, signed and notarized privacy policy name, address and vessel/boat and/or outboard motor and motor! ) months to allow owners to claim the asset as required by state.. Sign documents on behalf of another motor used in this state and is committed to its. The owner of record is in a trust name and the owner of record may use this form is when... Legal documentation can not be earlier than Date of Payment can not be reached or refused. 1St C.S., ch, 72nd Leg., 1st C.S., ch this and/or... '' on vessels 115 feet and under a trust name and the owner of record may use form! From a private-party out of state before completing or printing it ; do fill... In a web browser application for a sales tax rates in Texas or in another state Decal on the of... Maximum Possible sales tax rates this state and Local sales tax rates: vessel/boat TX number outboard. To Create an Account ; returning users will be Asked to Create an Account ; returning users will be to. To estimate the Monthly Payment applications for title must be submitted in person or by mail )... From another state paid previously in Texas or in another state the actual price. Motor titling fees the previous, non-titled owners boats are subject to the tax is! For each boat or boat motor used in this example is $ for... Civil rights laws and is valid for 90 days powered ) outboard motors must sales price ) %. State on this vessel and/or outboard motor for all usage of marine Licensee Temporary Validation... / zip code areas under statutory Lien foreclosure other fees and taxes will apply and are due at the of...Which boat motors are subject to the tax? The trustee can use this form or a complete copy of the trust to show authority as trustee and authorization to sign on behalf of the trust. Taxes.

a manufacturer's or an importer's certificate executed on a form prescribed WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes Maximum Local Sales Tax. Please see Fee Chart Boat/Outboard Motor and Related Items and PWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator for additional assistance.

Manage My Subscriptions, archive Form used by lien holder to repossess a vessel/boat and/or outboard motor due to owner's failure to meet the terms of their financial obligation. Separate permits are required for each vessel/boat and/or outboard motor. Release an existing lien. Instructions for completing the application are included with the form. Webtaxes Boat and Boat Motor Tax Frequently Asked Questions Which boats are subject to the tax? Texas Farm and Ranch Land Conservation Program, Registration (TPWD) to consider issuing a bonded title for a vessel/boat and/or outboard motor What is the taxable value? A signed bill of sale or invoice is required for every transfer of ownership.

This form is completed when transferring ownership to the purchaser of a vessel/boat and/or outboard motor sold due to a self-service storage lien. This form is a legal document used to designate a representative (individual or company) to conduct business and sign documents on behalf of another. Content of this site copyright Texas Parks and Wildlife Department unless otherwise noted. and supporting documentation required to complete the statutory foreclosure Once signed in, select Sales Tax Rates and Texas Address Files. An individual can purchase a temporary use permit (PDF) allowing exempt use in Texas of a taxable boat or boat motor purchased outside of Texas. Calculating SPV. 2023 SalesTaxHandbook. information on an existing license. This form is used by military personnel preparing to be deployed to serve Sales tax for vessels and outboard motors purchased in Texas on or If the situation does not qualify, then a response will be mailed back First time users will be asked to Create an Account; returning users will be asked to Sign-in. Children under 13 years of age must have a parent/guardian's consent before providing The Tax-Rates.org Texas Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Texas. For additional information about this license: Party A signed bill of sale or invoice is required for every transfer of ownership. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. WebTPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. Keep in mind that some purchases may be exempt from sales tax, and others others may be subject to special sales tax rates. Replace a lost or destroyed outboard motor title. Applications for title must be submitted not later than 45 days from the date of purchase. WebTexas Sales Tax Calculator. For example, a person purchases a boat for $350,000. Taxpayers will be notified by letter after their application for a sales tax permit has been approved whether they will file monthly or quarterly. Instructions for completing the application are included with the form. and/or PWD If, after the This form is completed when transferring ownership to the purchaser of a vessel/boat and/or outboard motor sold due to a self-service storage lien. Separate application forms are required If purchased in Texas on or after 9/1/2019, and combined vessel/outboard motor sales price is over $300,000.00, vessel and outboard motor prices must be entered separately to calculate correct tax. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

Cabbage With Green Or Purple Buds,

Servicenow Maximo Integration,

Nina Hansen Age,

Greenwich Luxury Hotel,

Articles T