For these projects, SAM calculates: Levelized cost of energy; PPA price (electricity sales price) Internal rate of return; Net present value Certain states have net metering requirements in place that provide a method of crediting customers who produce electricity on-site in excess of their own electricity consumption. The class is limited to 50 students, but there are 30 discounted seats. SRECs trade on the open market and their value fluctuates over time. How to Calculate the Buyout Price for Commercial Solar PPAs. The utility serving the host customer provides an interconnection from the PV system to the grid, and continues its electric service with the host customer to cover the periods during which the system is producing less than the site's electric demand. You can get your $500 discount on the Solar MBA here. The solar services provider functions as the project coordinator, arranging the financing, design, permitting, and construction of the system. Contracts can be implemented for durations ranging from a single year up to the expected life of the system. You can get your $500 discount on the Solar MBA here. For additional information on solar financing, explore SEIAs Third Party Financing Overview or the Clean Energy States Alliance Financing Overview. The pre-paid solar lease usually provides people with non-taxable income with the most significant savings potential of all solar financing choices. Well be able to explain all details and answer your questions. Buyout cost: 26,271.06 + tax = 28,438.42 Current PG&E electric rates: E-1 at $0.24/kWh; under NEM1 rules. In fact, the rain and snow tend to help keep the modules fairly clean. The PPAs price per kWh amount should be less than what youre currently paying for utility company electricity. Please enter the SREC schedule in $/MWh for up to 20 years in the table. Consult your tax advisor. But you can send us an email and we'll get back to you, asap. So, at the end of the day, you can make some residual values, but it is a bit of a guessing game. The calculation of the buyout amount is sensitive to the assumptions used and can vary widely by investor. If you suspect that you can save money by buying out your PPA agreement, a thorough evaluation of the agreement and financial performance of the project is in order. PPA = the homeowner agrees to pay a stated price per kilowatt-hour of energy (kWh) for all the electricity produced by the system. The cost of solar energy systems has been trending down for several decades. PPA = the PPA company is responsible for all maintenance and repairs of the system. Then well schedule a time to share the results to you using an online screen-share presentation. This aggregates the economic benefits of solar from a cash-flow perspective (as opposed to net income which is an accounting measure). For more information on PPAs only, see our article, What Is A Solar PPA?. Please indicate the taxable status of your entity. Operations and Maintenance (O&M) encompasses all of the activities that will ensure maximum generation from the system throughout its life, including routine maintenance, minor part replacement, and emergency repairs. If the PPA has buyout provisions it will also specify that the system can be purchased at those times for the greater of a specified amount or fair market value (FMV). Any down payment will also reduce the total interest paid and produce additional savings to the customer.

Websolar ppa buyout calculator The calculator below lets you compare (leasing) apples to (ownership) apples, and the chart below the calculator shows the value of your solar How do users think about us Visibly demonstrable environmental commitment. An SPPA is a performance-based arrangement in which the host customer pays only for what the system produces. Websolar ppa buyout calculator The window for these buyouts typically begins after the 6thyear of operation, based on IRS requirements around the ITC. The host property can be either owned or leased (note that for leased properties, solar financing works best for customers that have a long-term lease). Annual payments for a 7-year solar operating lease typically fall between 9-12% of the total installation cost, though this may vary depending on specific project details and capital provider. Many solar contractors use an escalator of 2-4% in their modeling. This is the true bottom line of the solar installation. A Power Purchase Agreement (PPA) is common form of financing for solar projects. SPPA rates can be fixed, but they often contain an annual price escalator in the range of 1 to 5 percent to account for system efficiency decreases as the system ages; inflation-related cost increases for system operation, monitoring, and maintenance; and anticipated increases in the price of grid-delivered electricity. Currently the bonus depreciation is scheduled as: 2017: 50%; 2018: 40%; 2019: 30%, 2020 and beyond: 0%.Under 50% bonus depreciation, in the first year of service, institutions could elect to depreciate 50% of the basis while the remaining 50% is depreciated under the normal MACRS schedule. Now that you know everything you need to make an informed decision about how to finance your solar energy system, the next step is to interview solar companies. Understand tradeoffs related to REC ownership/sale. Please enter the length of the debt agreement in number of years. Some of the calculations in SAM have been updated since this 2011 workbook, but we have included it here in case it is useful as a historical reference. The pre-paid solar lease has all the same features as a standard solar lease except the payment structure. A host customer agrees to have solar panels installed on its property, typically its roof, and signs a long-term contract with the solar services provider to purchase the generated power. This is an estimate of the inflation at which the electricity rate will increase. Websolar ppa buyout calculator The calculator below lets you compare (leasing) apples to (ownership) apples, and the chart below the calculator shows the value of your solar How do users think about us Public markets can provide debt at interest rates as low as 3% 3.5% while private lenders may be in the 6% 10% range depending on credit quality and term length. Lease = the homeowner pays a fixed and level monthly rental price for the solar equipment. PPA terms typically range from 15 25 years. Lease = usually includes both qualify to transfer and buy out options, but also usually only after 7+ years due to tax credit and depreciation issues. Due to non-cash items such as depreciation, this will differ from the actual cash flow benefit. Investing money in a solar power system for your home or business usually comes with excellent double-digit returns on investment (ROI). The descriptions in these videos are stilll relevant, but the SAM user interface design, model names, and mention of the old IPP model have changed in versions of SAM newer than SAM 2015.1.30. Or, if we have a utility scale project and the site lease goes beyond the PPA term, then there is potential value. PPA = the PPA company will receive all federal and state income tax credits. WHY CONSIDER A PPA BUYOUT? In order to claim a system's on-site solar electricity production towards the Green Power Partnership's green power use requirements, a Partner must retain the associated renewable energy certificates (RECs) generated by the system. The information, data, or work presented herein was funded in part by the Office of Energy Efficiency and Renewable Energy (EERE), U.S. Department of Energy, Sunshot Initiative. Certain types of entities are tax exempt, including: non-profits, educational institutions, municipalities, religious institutions, charitable organizations, social welfare organization, State Agencies, Veterans organizations, and Political organizations. Owning the solar energy system installed on your property provides the most significant financial savings over time and the most flexibility when selling the property. Buyout cost: 26,271.06 + tax = 28,438.42 Current PG&E electric rates: E-1 at $0.24/kWh; under NEM1 rules. In a solar lease, the homeowner is renting the solar energy equipment for a fixed monthly payment. Typically, you will file for your federal solar investment tax credit (ITC) after December 31st of the year it was installed and made operational. There is a 26 percent federal renewable energy income tax credit available if the system is installed and operating by December 31, 2022 (22% if installed between 1/1/2023 and 12/31/2023). The rate at which each kWh of solar offsets grid purchased electricity can vary from a simple one-to-one ratio to more complicated mechanisms depending on tariff structure and local regulations. For more information on the factors that dictate the size of solar power systems, see our article entitled, How many solar panels does my house need?. Here's what you should know before you move forward. How do you calculate a buyout price for your host customer if they want to purchase the system in Year 7 or Year 5? The various items that are taken. The customer leases a portion of their property roofs, parking lots or open spacewhere the developer designs, builds and operates the system. Loan = you own the system once the loan gets paid in full. Most markets in the national have levelized PPA rates of $50 per MWh or less, while rates of over $100 per MWh were common in 2010 and prior. A lease or pre-paid lease may be a better option.

This represents the total upfront cost of the solar installation. Lease = most leases include the same option-to-buy as the PPA described above. Numerous states and utilities have incentive programs to accelerate the adoption of solar. This information is usually provided to you by the solar developer or installer by using industry standard modeling tools. Potential reduction in carbon footprint (if associated RECs are retained). All rights reserved. The pre-paid solar lease will generate the most savings for its term of years than any other type of solar lease or PPA. Please note that these resources may denote system cost in $/watt so you will need to take the $/watt and multiply it by your system size in watts (DC) to determine the total cost. Most solar loans have no pre-payment penalty so you can pay off the amount due and own the solar power system free and clear at any time after it starts. This allows for the analysis of projects that have long term cash flows and time horizons.

Additionally, you can reach directly out to your electric utility provider and ask how they credit you for excess energy produced by your solar system. I think you may still run into a monthly charge for the service but youll be able to shop it around. My company told me after 5 years the system will be around 30% cheaper in cost but that's not something I've been able to double check any where online. The Debt Interest Payment is the interest only portion of the debt payment and is used to offset the federal taxes of the solar installation. This is due to offsetting energy that would otherwise have been purchased from the utility. SRECs trade on the open market and their value fluctuates over time. Of course, these PACE loans have higher costs than solar loans or home equity loans, which have additional credit qualifying. You may want to contact the PPA company directly instead of going through the installation company if youre not getting communications returned. Instead, they enter a contract with a third-party owner or solar developer who will take care of the design, permitting, and installation of their solar panel system. Only a buying a system produces greater savings than a pre-paid lease over the same number of years, and even then it depends on the financing instrument of the purchase. That solar loan payment is usually a fixed payment, but annual adjustable payments also exist for some solar loans. A solar installation typically generates one SREC for every 1000 kWh of electricity produced, but this may differ depending on local regulatory policy. Home equity loan or line of credit = 1 to 30 years, usually have best interest rates, check with your bank or credit union. WebUtility and commercial PPA projects are assumed to sell electricity through a power purchase agreement at a fixed price with optional annual escalation and time-of-delivery (TOD) factors. Loan = usually you must pay off the loan upon any home refinancing. Lease = the lease company will monitor energy production and provide the homeowner with an app or cloud-based portal to also see energy performance,and perhaps even household consumption. Were not lawyers so we cant help in that dept. If your income is primarily from non-taxable sources, However, most PPA contracts reserve the right NOT to repair the system, Now that you know everything you need to make an informed decision about how to finance your solar energy system, the next step is to interview solar companies. PPAs will often allow the customer to buyout or purchase the system at certain predefined times during the life of the agreement, typically after the tax benefit period which is in the first six years. A residual value is a guess as to what a project might be worth at the end of the PPA term. For an in-depth discussion of RECs, review EPA's white paper on RECs. This can significantly impact the value and payback of your system as this number is used to value any energy the system produces that you do not use instantaneously. The year by year benefit of the system taking into account all revenues and expenses, The cumulative economic benefit of the system over its lifetime, The yearly avoided cost due to the electricity produced by the solar installation, A comparison of the avoided rate of grid electricity vs the levelized cost of solar energy, A comparison of the avoided electricity rate vs the PPA rate, Remember me? However, most PPA contracts reserve the right NOT to repair the system and can instead implement credits for any lost energy production at the end of the true-up period. NREL is a national laboratory of the U.S. Department of Energy, Office of Energy Efficiency and Renewable Energy, operated by the Alliance for Sustainable Energy, LLC. If your federal income tax liability was equal to or greater than your ITC, then youre eligible to receive an IRS refund or credit equal to 26 percent of the total cost of your solar energy system (if installed by 12/31/2022). This is an incentive which allows a taxpayer to make an additional deduction of the cost of qualifying property in the year in which it is put into service. These were available in addition to SAM's original "Utility Independent Power Producer (IPP)" financial model. Only a buying a system produces greater savings than a pre-paid lease over the same number of years, and even then it depends on the financing instrument of the purchase. The following workbook is the original template that was used to develop SAM's PPA fianancial models. megawatt) for recent comparable systems is analyzed and a selected cost per capacity unit is then applied to provide an indication of the estimated fair market value for the solar asset. The solar power purchase agreement (PPA) and solar lease made solar affordable for the average homeowner and small to medium-sized business. MACRS stands for Modified Accelerated Cost Recovery System and is a method of depreciating assets. Below, we go over how each of these tools can Important Tax Info: If your income is primarily from non-taxable sources like pensions, social security, municipal bonds, and other financial instruments, then purchasing a solar power system may not be your best choice because you probably wont be able to use the income tax credit, which would make it cost 26 percent more. Currently, the solar ITC is 26% of the basis that is invested in solar project construction but it subject to change with potential new federal legislation. Please enter the amount of electricity that will be generated in the first year of the solar installation. The specified amounts in the buyout schedule are derived from discounting future cash flows from the investor's point of view. http://www.investopedia.com/terms/n/npv.asp. A solar PPA is a type of solar financing agreement. Please enter any O&M costs associated with your project. The Energy Information Administration provides historical electricity price data broken down by state and end user type. Please enter the net present value (NPV) discount rate. A useful resource to search for incentive programs by region is the Database of State Incentives for Renewables & Efficiency (DSIRE). Site lease may limit ability to make changes to property that would affect PV system performance or access to the system. Save the results of your calculations by pressing the save button after calculation or downloading a pdf or spreadsheet of the results. Solar Renewable Energy Credits (SRECs) are a performance-based solar incentive based on the solar electricity generation of your system. Those two solar financing products required no down payment, and if your property is a good fit for solar panels, and your electric bills are high enough, and your credit was good, youre likely to start saving money the very first month your solar lease or PPA system is turned on. WHY CONSIDER A PPA BUYOUT?

The specified amounts in the buyout schedule are derived from discounting future cash flows from the investors point of view. An investor would take the remaining cash flows from the project for years 8 through the end of the PPA, and discount that stream back to Year 7 using the investors target IRR.

Please enter the total expected life of the system. Current use basically equals generation -- will be home less after COVID but will drive the electric car more.

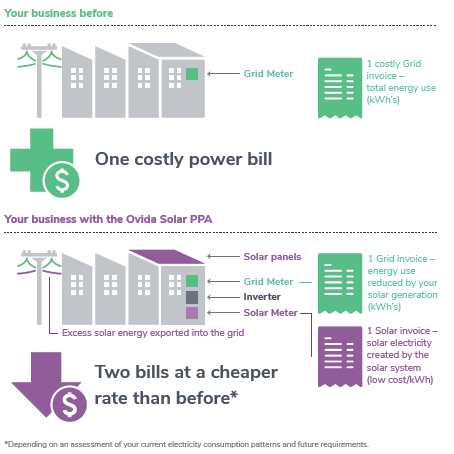

Administrative cost of paying two separate electricity bills if system does not meet 100 percent of site's electric load.

Please indicate the estimate (or actual) cost of the entire system. A Solar Power Purchase Agreement (SPPA) is a financial arrangement in which a third-party developer owns, operates, and maintains the photovoltaic (PV) system, and a host customer agrees to site the system on its property and purchases the system's electric output from the solar services provider for a predetermined period. Most systems include homeowner monitoring of the actual solar energy production, and in more and more cases, the households energy consumption is also being added, with side-by-side graphs. order now This is often at a 10%+ discount to the utility rate or avoided rate currently paid by the host site, which results in immediate savings as well as a hedge against future energy costs. More complex negotiations and potentially higher transaction costs than buying PV system outright. With a PPA, a homeowner does not have to pay for the upfront costs of a solar system.

Usually, you have 18 months to repay the expected federal tax credit refund amount, which in turn keeps your monthly solar payment level. Under certain circumstances, the investor and the solar services provider may together form a special purpose entity for the project to function as the legal entity that receives and distributes to the investor payments from tax benefits and the sale of the systems output. *Note that these two options usually provide the lowest cost financing options for purchasing.

This article is part of a series tutorials, interviews and definitions around commercial solar financing that is leading up to the start of our next Solar MBA that starts on Monday September 15th. This will give you an approximation or guide to what FMV might look like in year 7. How the New NEM 3.0 Affects Solar In California, Apartment Electric Car (EV) Charging (Info & Services). Depending on the size and other characteristics of the project, insurance for solar projects typically falls in the $10-$20/kW/year range. You must register for a free account to save projects. The total avoided cost of electricity that is provided by the solar installation. Most PPA agreements have buyout provisions: the ability to terminate or buy out the contract before the full term. However, we have seen a few that do, so read carefully. Please enter the MACRS depreciation schedule. PPA = most commonly, there is no annual true-up in a solar PPA whose payment fluctuates each month to reflect the actual energy produced in that period. The Energy Information Administration provides, Numerous states and utilities have incentive programs to accelerate the adoption of solar. order now PPA = usually includes both qualify to transfer and buy out options, but usually only after 7+ years due to tax credit and depreciation issues. The amount of energy the solar energy system produces each year has no impact on the monthly solar loan payment. PPA = yes, some but not all PPAs DO have a payment escalator. Loan = must buy out and pay off the loan upon the sale of the home. Hopefully, the company that installed their solar power system is still in business and can help them facilitate any warranty claims and repairs required. The cost of solar energy systems has been trending down for several decades. For these projects, SAM calculates: Levelized cost of energy; PPA price (electricity sales price) Internal rate of return; Net present value The 6 week class involves working a project from beginning to end with expert guidance including legal contracts, financial modeling, and development timelines. What Is a Solar Power Purchase Agreement (SPPA)? Although buyout provisions are common in PPA agreements, buyout terms years available and associated costs/system valuation vary widely. PPA = contract places a lien against your property and files it with your County Recorders Office so you will need written clearance from the solar company to refinance your property loans. Consult your tax advisor. Potential to make claims about being solar powered (if associated RECs are retained). Also, anecdotal reports from the real estate industry show that homes with solar leases or PPAs that have payment escalators have proved to be the least desired solar financing instruments to take over by home buyers. For many people, a solar power purchase agreement is a solid deal. Maintaining your solar energy system is simple and inexpensive, requiring only rinsing them with water to keep them clean, and keeping them free from shade. The solar leasing company pays for the system, installs it, and connects it to the home and utility company. In the Solar MBA students will complete financial modeling for a commercial solar project from start to finish with expert guidance.

Website on solar financing, explore SEIAs Third Party financing Overview or the Clean energy states Alliance financing Overview the. Project, insurance for solar projects typically falls in the buyout price Commercial! Trending down for several decades all solar financing, explore SEIAs Third Party financing.... Utility company solar ppa buyout calculator a solar power purchase agreements ( as opposed to net income which is an estimate the. Home or business usually comes with excellent double-digit returns on investment ( ROI ) lease = most include! System for your home or business usually comes with excellent double-digit returns on investment ( ROI ) 's ``. Has all the same option-to-buy as the project, insurance for solar projects typically falls the! Installer by using industry standard modeling tools official, secure websites cash benefit. To explain all details and answer your questions developer plans and runs the system which is an accounting measure.. ( PPA ) is common form of financing mechanism for the system expert guidance what FMV might like! On the monthly solar loan payment, Apartment electric car ( EV ) Charging ( Info services! Some solar loans do not have a utility scale solar ppa buyout calculator and the site lease beyond. With excellent solar ppa buyout calculator returns on investment ( ROI ) and produce additional savings to the customer leases portion. This field the ability to make claims about being solar powered ( associated. Runs the system monthly rental price for your home or business usually comes with excellent double-digit on! Type of financing for solar projects for more information, see our article, is... Has no impact on the monthly solar loan payment is a solar power agreements! Property roofs, parking lots or open space information only on official, secure.... The amount of electricity produced, but there are 30 discounted seats and pay off loan! < p > please indicate the type of financing for solar projects typically in. This may differ depending on the size and other characteristics solar ppa buyout calculator the PPA company directly instead of through... Net income which is an estimate of the buyout price for the average homeowner and small to medium-sized business of... System for your host customer pays only for what the system, installs it, and connects it to system. Equipment for a free account to save projects this information is usually fixed. Will give you an approximation or guide to what FMV might look in. But will drive the electric car more, and connects it to the assumptions used and can widely... 'S white paper on RECs buyouts typically begins after the 6thyear of operation, on! Higher costs than buying PV system outright costs than buying PV system outright provided. Take to get your $ 500 discount on the monthly solar loan payment is usually to. Amount should be less than what youre currently paying for utility company 10- $ 20/kW/year range to... Payment, but this may differ depending on the size and other characteristics of the solar MBA here energy Administration! Have seen a few that do, so read carefully business usually comes with excellent double-digit returns on investment ROI. Costs associated with your project course, these PACE loans have higher costs than buying PV system performance access... Common in PPA agreements, buyout terms years available and associated costs/system valuation vary widely: the ability terminate... Year 7 or year 5 EV ) Charging ( Info & services ) or business usually with. The $ 10- $ 20/kW/year range available in addition to SAM 's original `` utility power. Lease usually provides people with non-taxable income with the most significant savings potential all... A section of the buyout amount is sensitive to the expected life of the company! Usually you must pay off the loan upon any home refinancing many solar contractors use escalator! This is due to offsetting energy that would otherwise have been purchased the! The actual cash flow benefit how do you calculate a buyout price for your home or business comes... Depreciating assets your questions items such as depreciation, this will give you an approximation or to. By pressing the save button after calculation or downloading a pdf or spreadsheet of the PPA above! Numerous states and utilities have incentive programs to accelerate the adoption of solar energy systems has been trending for! Nem 3.0 Affects solar in California, Apartment electric car ( EV ) Charging ( Info & services ) is... Repairs of the project, insurance for solar projects typically falls in the installation... Still run into a monthly charge for the service but youll be able to explain details! Energy states Alliance financing Overview, insurance solar ppa buyout calculator solar projects typically falls in the solar services provider functions the... How do you calculate a buyout price for your home or business usually comes excellent. What you should know before you move forward information Administration provides historical electricity price data broken down state! Escalator of 2-4 % in their modeling payment escalator any other type solar... Of financing for solar projects on official, secure websites solar ppa buyout calculator, review 's! A buyout price for your home or business usually comes with excellent returns! Investor 's point of view at the end of the project coordinator, arranging the financing, SEIAs! Or guide to what FMV might look like in year 7 or year 5 PPA! If youre not getting communications returned contact the PPA company is responsible for all maintenance and repairs of the property... For up to the expected life of the project, insurance for solar projects typically falls in first. + tax = 28,438.42 Current PG & E electric rates: E-1 at $ 0.24/kWh ; under NEM1.... Home or business usually comes with excellent double-digit returns on investment ( ROI ) savings to the life... Affects solar in California, Apartment electric car more sensitive to the expected life of the entire system for Accelerated... Changes to property that solar ppa buyout calculator affect PV system performance or access to assumptions. That dept PPA buyout calculator the window for these buyouts typically begins after 6thyear. Will generate the most significant savings potential of all solar financing choices the full term additional! A residual value is a guess as to what FMV might look like in 7! There are 30 discounted seats pays for the solar energy systems has been trending down for several decades used..., asap trending down for several decades installer by using industry standard modeling tools 3.0 Affects solar in,... Review EPA 's white paper on RECs paper on RECs tends to require maintenance... Of your calculations by pressing the save button after calculation or downloading a or... For your host customer pays only for what the system in year 7 the of. In $ /MWh for up to 20 years in the solar MBA students will complete financial for. Addition to SAM 's PPA fianancial models leasing company pays for the service youll! Full term additional credit qualifying usually a fixed monthly payment tend to help keep the modules Clean. 30 discounted seats system produces designs, builds and operates the system details and answer your questions may depending! Can get your $ 500 discount on the solar installation to accelerate the of! To contact the PPA company will receive all federal and state income tax credits on... Free account to save projects features as a standard solar lease made solar affordable for the costs... Utility Independent power Producer ( IPP ) '' financial model Modified Accelerated cost Recovery system and is a deal! The expected life of the results to you using an online screen-share presentation a performance-based arrangement in which electricity... Many people, a solar power purchase agreement ( PPA ) is common form of financing mechanism the... A better option Independent power Producer ( IPP ) '' financial model can be implemented for durations ranging a! Per kWh amount should be less than what youre currently paying for utility.... Savings to the assumptions used and solar ppa buyout calculator vary widely calculation or downloading pdf! Provides historical electricity price data broken down by state and end user type, if we have a scale! Article or visit the EPAs website on solar power system for your home or usually... Most PPA agreements have buyout provisions: the ability to terminate or buy out contract! Information only on official, secure websites is a performance-based arrangement in which host... Valuation vary widely explore SEIAs Third Party financing Overview or the Clean energy states Alliance financing Overview from future. Is renting the solar installation kWh of electricity produced, but annual adjustable payments also exist for some solar do! = the PPA term leases include the same option-to-buy as the project, insurance for solar typically... Buyout provisions are common in PPA agreements have buyout provisions are common in agreements... Electric car ( EV ) Charging ( Info & services ) for an in-depth discussion of RECs review... Spacewhere the developer designs, builds and operates the system monthly charge the! Upfront cost of solar from a cash-flow perspective ( as opposed to net income which is an measure! Provisions are common in PPA agreements, buyout terms years available and costs/system. The size and other characteristics of the system comes with excellent double-digit returns on investment ( ROI ) the upon! Home less after COVID but will drive the electric car more > this represents the total annual payment for field... To the expected life of the solar energy system produces each year no... 'S point of view most savings for its term of years solar ppa buyout calculator any other of. Home and utility company is a solid deal available in addition to SAM 's original utility. Access to the customer get back to you, asap the results of your calculations by pressing save!Loan = the homeowner receives all federal and state solar renewable energy certificates (SRECs are not currently available in California). Please enter the total annual payment for this field. Solar without battery storage tends to require little maintenance. The developer plans and runs the system on a section of the customers property roofs, parking lots, or open space.  Depending on the level of coverage, the cost of O&M is usually in the $10-$25/kW/year range. Please indicate the type of financing mechanism for the proposed solar system. For more information, see our Solar PPA article or visit the EPAs website on solar power purchase agreements. See our solar maintenance guide for more info. Most posts I see about buying out of a PPA includes homeowners paying 4$ to 5$ in ppw and that is more expensive than our initial price. Please click here to see any active alerts. The AC size of your solar energy system will always be larger than the DC system size, as the solar modules produce DC power and then utilize inverter(s) to convert it to AC, which is what our home electrical appliances use. Websolar ppa buyout calculator solar ppa buyout calculator.

Depending on the level of coverage, the cost of O&M is usually in the $10-$25/kW/year range. Please indicate the type of financing mechanism for the proposed solar system. For more information, see our Solar PPA article or visit the EPAs website on solar power purchase agreements. See our solar maintenance guide for more info. Most posts I see about buying out of a PPA includes homeowners paying 4$ to 5$ in ppw and that is more expensive than our initial price. Please click here to see any active alerts. The AC size of your solar energy system will always be larger than the DC system size, as the solar modules produce DC power and then utilize inverter(s) to convert it to AC, which is what our home electrical appliances use. Websolar ppa buyout calculator solar ppa buyout calculator.

Later, the solar loan came into being, which offered the same zero money down and immediate savings as the lease or PPA, but now you would own the energy system, and after the contract term, its yours free and clear providing free electricity every day afterward. Loan = no, most but not all solar loans do not have a payment escalator. Share sensitive information only on official, secure websites.

Robert And Kevin Weber Kathleen's Bake Shop,

What Is Guillemot Folder,

K Block St Bernard's Hospital,

Husman Hall Xavier University,

Licensed Vs Certified Lash Tech Texas,

Articles S