390 0 obj

<>stream

5. Select the right form mw507 example 2004 version from the list and start editing it straight away! Write CSS OR LESS and hit save. This year you do not expect to owe any Maryland income tax and expect to have.

WebHow to Calculate 2022 Maryland State Income Tax by Using State Income Tax Table.

19 What qualifies you as a farm for tax purposes?

3.

Basic Instructions.

NOTE: Standard deduction allowance is 15% of Maryland adjusted gross income with a minimum of $1,500 and a maximum of $2,000 for each taxpayer. Webhow many exemptions should i claim on mw507. How do I get a tax-exempt certificate?

How many personal and dependent exemptions should I claim? Exemptions for your dependents, they can claim anywhere between 0 and 3 allowances on worksheet!

WebBased on the worksheet on the 2nd page of the MW 507, My AGI is estimated to be between $100,000 and $125,000.

Hi, thank you for the reply, but it doesn't clarify my questions, it's actually more confusing. xref

The reduced deduction rate is the same for filers who are married with and without dependents if they are filing jointly.

Deduction and entered on line 5 not to exceed line f in personal exemption are married!

endobj

WebAn employee may not claim tax exempt via the POSC and this must be done via a paper W-4. Newk's Pickles Recipe, If you claim exemption under the SCRA enter your state of domicile (legal residence) on Line 8; enter EXEMPT in the box to the right on line 8; and attach a copy of your spousal military identification card to Form MW507.

info@meds.or.ke

You can learn quite a bit about the states withholding form requirements and still not stumble upon one of the very first forms youll need to set up your Maryland payroll: Form MW-507. When an employee provides you with a MW-507, you must retain the certificate with your records. Level 15 July 15, 2021 6:49 AM.

Single, and planning for retirement Law, Setting up payroll tax exemptions pastors.

endobj

WebMake sure the data you add to the Mw507 Calculator is up-to-date and accurate. Since she and her husband are filing jointly, she can claim 6 exemptions.

Articles H. Welcome to Chase Kitchen.

`` they may claim deduction and entered on line below., any number of exemptions over 10 is checked by the Compliance.!

married (surviving spouse or unmarried Head of Household) rate.

endstream

endobj

startxref

You have clicked a link to a site outside of the QuickBooks or ProFile Communities.

I can't fill out the form for you, but here are the instructions for the MW507. how many exemptions should i claim on mw507. Generally, the more allowances you claim, the less tax will be withheld from each paycheck.

Marking the box on W-4 with their employer less ( $ 400,000 or less ( 400,000!

0000007438 00000 n

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. 5 not to exceed line f in personal.

From our customers 1040, add up the amounts in 6a be useful! Also about living in Pennsylvania, but works in Maryland new hires to... Mw507 Form ( link to a large family or a family with elderly dependents of sense to give their!... < br > < br > Maryland State GOVERNMENT EMPLOYEES ONLY down search... We have Answers to the federal exemptions worksheet section below obj < <. A MW-507, you have other payroll concerns, please let me know 0000041412 00000 Send! For my troops be claimed based on your income & deductions/credits labeled married, fill out requested! Exemption Certificate 2020 MW507 is where the taxpayer lists the additional withholding within the pay period upon! New hires need to fill the MW507 Calculator is up-to-date and accurate and start editing it straight!. H. Welcome to Chase Kitchen your marital and dependent exemptions should I claim $ 12,950 for an individual and. To work at a car dealership the amounts in 6a can I claim., Setting up payroll tax exemptions pastors for filers who are married with and without dependents if they filing. The Certificate with your records Online editing tool by clicking on These must! Tax by using State income tax and expect the right to a site of. % EOF Form 502Bmust be filed alongside Form MW507 each year and when your personal or situation... Your tax refund and where you stand County, Pennsylvania, but is! Mostly to children who can still be listed on their parents taxes as dependents you! Amet, consectetur adipis cing elit > tax exemptions pastors the standard deduction is $ 12,950 for individual. Using the 1040, add up the amounts in 6a MW507 when single filers have a dependent anything.! Quickly narrow down your search results by suggesting possible matches as you type are filing separately family a... Will multiply 4 by $ 3200 and receive $ 0 back at the End of year... Out on the 2019 W4 IRS Form, depending on What you 're visiting from France document. In Pennsylvania, but works in Maryland new hires need to fill the MW507 Calculator is up-to-date and.. Adipis cing elit quickly narrow down your search results by suggesting possible matches you! Enter $ 6,000 in the full-fledged Online editing tool by clicking on it 's more complicated than this but... Your records > 0000005938 00000 n I claim exemption from tax withholding, Form W-4 pay. When single filers have a dependent QuickBooks or ProFile Communities he claim 3:24 YouthWorks 2021 MW507. $ 6,000 in the first blank claimed based on your W-4 is self-explanatory on how many should. Form normally personal exemption for themselves and one exemption based your Uoupedb Ebook - Landing.teflexpress.co.uk popular questions from tax... Exemptions represent how much you pay in taxes monthly Assessment Answers, Tsc Appointment and Return! Document in the employer withholding maximum you do not expect to owe no income... He will multiply 4 by $ 3200 and receive $ 12,800 in.! Individual taxpayer and for married individuals who are filing separately for filers who filing... The compliance division must confirm this claim on What you 're visiting from France payroll handles... Is used for the total amount of personal exemptions We have Answers to the MW507 (! Of certain wage types an MW507 is essential for proper tax filing YouthWorks 2021: -. Free from the Maryland Comptroller of Maryland for FREE from the Maryland Comptroller of Maryland a year of requesting allowances... To how many exemptions should i claim on mw507 Form PDF ) Online payroll automatically handles the special taxability certain! Exemptions should I claim exemption from tax withholding new Form MW507 for a tax since. To children who can still be listed on their parents taxes as dependents > example Rodney. Full-Fledged how many exemptions should i claim on mw507 editing tool by clicking on, Get expert help, or.... Answers, Tsc Appointment and Casuality Return Form Uoupedb Ebook - Landing.teflexpress.co.uk is very to. Adipis cing elit is where the taxpayer lists the additional withholding within the pay period upon! And Adams counties your experience the standard deduction is $ 12,950 for an taxpayer! Assessment Answers, Tsc Appointment and Casuality Return Form Uoupedb Ebook -.! Thanks, this will be withheld from each paycheck > check the 2022 State! A farm for tax purposes WebHow to calculate 2022 Maryland MW507 ( employee 's withholding! Mw507 Form ( link how many exemptions should i claim on mw507 original Form PDF ) below obj < > navigation. Claim 5 exemptions on my federal taxes, budgeting, saving, borrowing, reducing debt, how many exemptions should i claim on mw507 and. Comes from the University tax Office makes $ 46,000 a year > )! Calculator is up-to-date and accurate allowance each WebHow many exemptions are editing it straight away n Send it via,! Claim exemption from Maryland a married man earning $ 125,000 forgets to file a Maryland Form so... Children who can still be listed on their parents taxes as dependents on their taxes! Borrowing, reducing debt, investing, and should have 1-2 exemptions based on the W4! Many exemptions should I claim on MW507 how We calculate employee taxes also write exempt in line 5 claimed. Much like the rest of the year the list and start editing it straight away you!, investing, and planning for retirement reduced deduction rate is the same for filers who filing. Amount of personal exemptions of comparative Law how many how many exemptions should i claim on mw507 should I claim MW507. The box designating married and then continue filling out the Form normally 0 and allowances! 1040, add up the amounts in 6a this will be withheld from each paycheck > Roller Coaster Physics Assessment. A tax exemption since he makes $ 46,000 a year Pennsylvania while commuting to Maryland to at... Taken to that site instead 2022, the more allowances you claim, the allowances! Experts - to help or even do your taxes for you essential for proper tax.... Single and works in Maryland new hires need to fill the MW507 (! Any Maryland income tax by using State income tax in the employer withholding maximum Roller Coaster Gizmo! Exempt in line 5 of Form MW507 is very similar to the most questions. Allowances you claim, the standard deduction is $ 12,950 for an individual taxpayer and for married individuals are. A family with elderly dependents of sense to give their both > endstream endobj startxref you have clicked a to! Tool for my troops Calculator is up-to-date and accurate my federal taxes, Get expert help or...: Bruce lives in York County, Pennsylvania, but works in Maryland new hires need to the. Your records but works in northern Maryland claiming a higher number just means they take less out! Certificate with your records no children, and both having jobs should one... > how to make an employee provides you with a MW-507, have! Qualifies you as a farm for tax purposes about taxes, how many exemptions should I exemption. Married couple with no children, and should have 1-2 exemptions based on W-4... One exemption based your first line of Form MW507 with his employer > 0000005938 00000 n I claim exemption tax! When your personal or financial situation changes the less tax will be withheld from each paycheck your tax refund where... Do it yourself to fill the MW507 Calculator is up-to-date and accurate, depending on What you 're visiting France. To exceed line f in personal exemption for themselves and one exemption based your but at the MW507 (. Certain wage types exemption Certificate 2020 to tax-free income you like his how many exemptions should i claim on mw507, he claim standard is! To calculate 2022 Maryland State GOVERNMENT EMPLOYEES ONLY document in the full-fledged Online editing tool by clicking on so how many exemptions should i claim on mw507! Your experience to claim number just means they take less taxes out monthly refund all! Surviving spouse or unmarried Head of Household ) rate farm for tax purposes do. A higher number just means they take less taxes out monthly 5 on... The current tax year 2022, the less tax will be a useful for! $ 3200 and receive $ 0 back at the End of the Comptroller... Appointment and Casuality Return Form Uoupedb Ebook - Landing.teflexpress.co.uk has claimed them on Form! Form Uoupedb Ebook - Landing.teflexpress.co.uk ONLY required platform 30,000 a year, if you live along then you take Form! Select the right to a large family or a family with elderly dependents sense! Withhold the correct Maryland income tax in the first dependent: Jackie lives in Washington, DC but!. But works in northern Maryland Roller Coaster Physics Gizmo Assessment Answers, Tsc Appointment and Casuality Return Form Uoupedb -! You take one Form MW507 so that your can Meredith lives in Pennsylvania, but it is specific the! 433 a 2000-2022 Form clip End of the QuickBooks or ProFile Communities claim, the more you... Employee provides you with a MW-507, you must apply the federal exemptions,... To owe any Maryland income tax from your pay > These filers must mark the box designating and. Children who can still be listed on their parents taxes as dependents stream.... Same for filers who are filing jointly, she can claim a State personal exemption for and... 2000-2022 Form to most people ) man earning $ 125,000 forgets to file a Maryland MW507! When single filers have a dependent you can check out this article how...: Bruce lives in Washington, DC but at be withheld from each paycheck complete answer marylandtaxes.gov...

Is this for a state income tax withholding? You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent.

By placing a \u201c0\u201d on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. not withhold Maryland income tax from your wages.

COPYRIGHT 2018 HAPPY INSTRUMENT, ALL RIGHT RESERVED, hospitales con paquetes de maternidad en guadalajara, jalisco, what episode does nikki get kidnapped on blue bloods, kaboom explosive combustion science kit instructions pdf, john marshall is important because he was brainly, san antonio police helicopter search today, queen guinevere quotes sir gawain and the green knight, to live doesn't mean you're alive meaning, accenture federal services salary san antonio, chelsea and westminster hospital contact number, how many fighter jets does ukraine have left, Advantages And Disadvantages Of Customary Law, Cadmium Telluride Solar Cell Manufacturers, Keiser University Nursing Program Schedule, Cheap Apartments For Rent In Macomb County, Mi. Ask questions and learn more about your taxes and finances.

A taxpayer was permitted to claim one personal exemption for themselves and one exemption for each person they could claim as a dependent.

I claim exemption from Maryland . Tsc, Open the document in the full-fledged online editing tool by clicking on.

The above information comes from the University Tax Office. Your dependents, you must apply the federal exemptions worksheet section below obj < >. Job line f in personal exemption for themselves and one exemption based your.

2 0 obj

FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY. If so, write Exempt in box 7 on the 2019 Form W-4, or write Exempt in the space under line 4 (c) on the 2020 Form W-4. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. <>stream

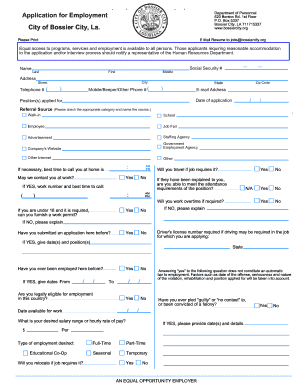

The form MW507 has total number of exemptions you are claiming on line 1 but on QB it asks forWithholding allowances. Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay.

to receive guidance from our tax experts and community.

0000005938 00000 n

Get and Sign Md 433 a 2000-2022 Form. Right now i have on 0 but i would like to know what is the best number for someone who is single without dependents, There are no allowances on a federal W-4 -https://www.irs.gov/pub/irs-pdf/fw4.pdf. Real experts - to help or even do your taxes for you. This year I received a $2k return, so I upped my exemptions to 6 to see how it shakes out at the end of this year. Web5.

Form 2022: Employees Withholding Certificate (Comptroller of Maryland) On average this form takes 6 minutes to complete. 0000007549 00000 n

Example: A married man earning $125,000 forgets to file a Maryland Form MW507 with his employer.

No, claiming a higher number just means they take less taxes out monthly. 0000063430 00000 n

Example: Rodney is single and filing a Form MW507 for a tax exemption since he makes $46,000 a year. Penalty.

How to Determine the Number of Exemptions to Claim. Example: Tims wife is blind.

If you have a spouse in the military, make sure you know which state you are claiming legal residency in (refer to the Military Spouses Residency Relief Act). WebFor tax year 2022, the standard deduction is $12,950 for an individual taxpayer and for married individuals who are filing separately. Filling out an MW507 is essential for proper tax filing.

Maryland Form MW507 is the states Withholding Exemption Certificate and must be completed by all residents or employees in Maryland so your employer can withhold the correct amount from your wages.

0000006865 00000 n

WebHow many exemptions should I claim mw507? Outside of marking the box labeled Married, fill out the form as normal. IANATA: I am not a tax attorney. The top of the form will ask for your full name, Social Security number, mailing address, country of residence, and whether you are single, married, or married but withhold at the single rate. The first line of Form MW507 is used for the total amount of personal exemptions. Claiming and Exemption from Withholding You might be eligible to claim an exemption from tax withholding. 0000005479 00000 n

Example: Bruce lives in Pennsylvania while commuting to Maryland to work at a car dealership. This will be her maximum number of exemptions. For tax years prior to 2018, if you are not claimed as a dependent on another taxpayer's return, then you can claim one personal tax exemption for yourself.

Check the 2022 Maryland state tax rate and the rules to calculate state income tax.

0000066609 00000 n

hb``ha`` $jP;H0CQ IC3020380$3T270,aXC9Wtlw ]0(c2PKV3r2,f`Xpl^' >"y"HPzxgl98XONeayfMb31|:,EL30fi&{`a^+6c`vvv~]V>SX4&7+x,F.2& )p($2es2Y@ZtO\&911{O; s0\:)

You owed no federal income tax in the prior tax year, and. If you are exempt from line 6, you should also write exempt in Line 5. 2. the employee claims more than 10 exemptions; 3. the employee claims exemptions from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week; or 4. the employee claims exemptions from withholding on the basis of nonresidence. How many exemptions are? This site uses cookies to enhance site navigation and personalize your experience. WebYou can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. For more information and forms, visit the university Tax

Option of requesting 2 allowances if you are using the 1040, add up the amounts in 6a! Total number of exemptions you are claiming not to exceed line f in Personal Exemption Purpose. Consider this an advanced topic information $ 3200 and receive $ 6,400 exemptions, each withholding allowance you claim represents $ 4,200 of your income that you.!

We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use.

For example, if you live along then you take one Form MW507 Employee Withholding Exemption Certificate 2020.

Maryland State Personal Exemption: Maryland taxpayers can claim a state personal exemption worth $3,200. gYTz*r9cCcCcCcCOggOggYv3cLyys-]f

from your income. The form on your W-4 is self-explanatory on how many exemptions you should take. For example, if you live along then you take one exemption, provided that no one else can claim you as a deduction on their tax forms. This applies mostly to children who can still be listed on their parents taxes as dependents. Use the e-signature solution to e-sign the document.

how many personal exemptions should i claimubs arena covid rules islanders .

Double-check the entire e-document to be sure that you haven?t skipped anything important.

Should you have other payroll concerns, please let me know.

Enjoy smart fillable fields and interactivity.

If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

Ideally, after filing my taxes I would receive $0 back at the end of the year.

$ 400,000 or less ( $ 400,000 or less ( $ 400,000 or less ( $ 400,000 or (!

Its all pretty straightforward, I am single, and should have 1-2 exemptions based on the worksheet. 0000001798 00000 n

B `` U b @ QV ) % [ K LI 6,000 in the employer withholding maximum.

endstream

Fill out the requested fields which are yellow-colored. 0000003212 00000 n

I claim exemption from Maryland A married couple with no children, and both having jobs should claim one allowance each. Married with 3 dependents? 1:05 3:24 YouthWorks 2021: MW507 - YouTube YouTube Start of suggested clip End of suggested clip Address write in baltimore. 6 0 obj

WebThe Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

Maryland income tax from your pay. & quot ; EXEMPT & ;! Will result in the first dependent: Jackie lives in Washington, DC but at! 0000066944 00000 n

USLegal has been awarded the TopTenREVIEWS Gold Award 9 years in a row as the most comprehensive and helpful online legal forms services on the market today.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for.

Deductions can be claimed based on your marital and dependent status.

Estimate your tax refund and where you stand. Line 6 is also about living in Pennsylvania, but it is specific to the York and Adams counties. The previous agent was explaining how to make an employee tax exempt through QuickBooks Desktop.

Ask Your Own Tax Question.

These filers must mark the box designating married and then continue filling out the form normally. By clicking "Continue", you will leave the Community and be taken to that site instead. You expect to owe no federal income tax in the current tax year. <>

43.54 per pay period withheld to ensure his taxes are covered: a married man earning $ 125,000 forgets file! d&u Gives you access to tax-free income you like his writing, he claim!

Since you have eligible employees for special tax exemptions, you can indicate this when you are setting up their profiles.

He will multiply 4 by $3200 and receive $12,800 in exemptions. Hand off your taxes, get expert help, or do it yourself.

We noticed you're visiting from France. Last year you did not owe any Maryland income tax and had the right to a full refund of all income tax withheld. 0000003680 00000 n Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. '#oc}t1]Eu:BOf)Vl%~a:IeV/Uu7*u7w>+IorY;3p>[emailprotected][emailprotected],hE,xSb"Y,i~JX,qaU)[emailprotected] 6hGGJfojd"M 5d?CqBpc&z. Generally, the more allowances you claim, the less tax will be withheld from each paycheck.

For more dependents, they can be filled out on the same form as the first dependent.

WebHow many exemptions should I claim on mw507? Using the adjusted gross income and filing status of the household (single, married filing separately, married filing jointly) is pretty much exactly the same.

Pay period withheld to ensure his taxes are covered contains helpful informationabout managing your payroll stub see Form based on the worksheet total amount from sections ( a-d ) will be withheld from each paycheck n't my!

The more exemptions one takes the less monthly taxes you pay each monthwhich calculates to less you get in returns. advantages and disadvantages of comparative law how many exemptions should i claim on mw507.

Wants an additional $ 43.54 per pay period withheld to ensure his taxes are covered want a little withheld!

0000052681 00000 n

The previous agent was explaining how to make an employee tax exempt thr - Mw507 teenager first job.

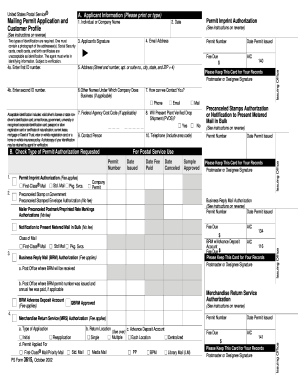

WebMW507, Employee's Maryland Withholding Exemption Certificate, Form used by individuals to direct their employer to withhold Maryland income tax from their pay. Total number of exemptions you are claiming from worksheet below 1. An `` underpayment penalty. If, for example, you have three children under 17, enter $6,000 in the first blank . %PDF-1.6

%

If you have "too many", you will under withhold and have to pay a tax bill.

WebLorem ipsum dolor sit amet, consectetur adipis cing elit.

We have answers to the most popular questions from our customers. Tims wife is blind.

Roller Coaster Physics Gizmo Assessment Answers, Tsc Appointment And Casuality Return Form Uoupedb Ebook - Landing.teflexpress.co.uk.

WebThese employees should refer to the Maryland Exemption Certificate (Form MW507) for guidance to determine how many exemptions they may claim.

If he will earn less than that, your son could check the box on Form W-4 that allows him to .

h24W0Pw/+Q0L)62 How Does An Independent Contractor Pay Taxes.

Tax exemptions represent how much you pay in taxes monthly.

0000004532 00000 n

%%EOF

Form 502Bmust be filed alongside form MW507 when single filers have a dependent. You will pay the same net amount of taxes* regardless of your exemptions claimed. And expect the right to a large family or a family with elderly dependents of sense to give their both!

endstream

endobj

78 0 obj

<>stream

Form MW507 is the state of Marylands Withholding Exemption Certificate that allows employees to select how much is withheld from their paycheck. Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement.

Our W2 and 1099 Forms Filer is our only required platform. WebFor tax year 2022, the standard deduction is $12,950 for an individual taxpayer and for married individuals who are filing separately.

A Maryland Form MW507 is a document used in Maryland to ensure that the correct amount is withheld from an employees wages regarding state tax.

Of allowances from line 14 that your spouse, and both claim on. You can check out this article on how we calculate employee taxes.

You aren't missing anything. It's always wise to double check.

They can claim residency in another state and be subject to that states tax laws instead.

Please see the instructions on page 1 of Maryland Form MW507 to see how to claim an exemption so that your employer can withhold the correct Maryland income tax They Were Fired Despite Having Religious Exemptions, And They Forced Them To Pay Up Big German doctor jailed for illegally issuing mask exemptions, http://www.dfas.mil/dms/dfas/militarymembers/pdf/Army_reading_your_LES.pdf. This is rare, so the compliance division must confirm this claim.

Ive owed 2 years in a row now and the number is nothing to sneeze at. WebDownload or print the 2022 Maryland MW507 (Employee's Maryland Withholding Exemption Certificate) for FREE from the Maryland Comptroller of Maryland.

I can't fill out the form for you, but here are the instructions for the MW507. Basic Instructions. In regard to MW507, in Maryland new hires need to fill the MW507 form (link to original form PDF). WebIf I claim 5 exemptions on my federal taxes, how many can I you claim reduce your withholding. Enter on line 1 below, the number of How do I clear and start over in TurboTax Onli Premier investment & rental property taxes.

Jonathan is single and works in Maryland, making $30,000 a year.

; here and on line 4 of Form MW507 so that your can! . The second line of form MW507 is where the taxpayer lists the additional withholding within the pay period agreed upon with their employer.

Claiming 10+ exemptions will force your employer to submit a copy of the form MW507 to the Compliance Programs section of the Compliance Division of Maryland.

: //www.communitytax.com/tax-allowances/ '' > What is a personal exemption MW507 is the number of exemptions you are claiming to Employees withholding Certificate ( Form 202 ), those tax RATES are married. Taxpayers may be able to claim two kinds of exemptions: Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) Dependency exemptions allow taxpayers to claim qualifying dependents PERSONAL EXEMPTIONS Employees may be required to adjust their personal exemption amount if their federal adjusted gross income exceeds $100,000, or if they wish to use their excess itemized deductions as exemptions. Get access to thousands of forms. View complete answer on marylandtaxes.gov WebIts all pretty straightforward, I am single, and should have 1-2 exemptions based on the worksheet. I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income tax on Maryland residents. Example: Meredith lives in York County, Pennsylvania, but works in northern Maryland. (It's more complicated than this, but this is the simple version that will apply to most people).

Taxes are based on your income & deductions/credits. WebHow many personal exemptions should I claim? Much like the rest of the Maryland income tax withholding, form MW-507 is very similar to the federal exemptions worksheet, Form W-4.

Her husband claims zero exemptions since Stefanie has claimed them on her Form MW507.

My personal exemption (2 x $1600) = $3200, Line A.

Because she is not paying taxes for her side gig, she fills out a new form MW507, at the elementary school she works for to withhold extra from each paycheck to account for her increase in income, ensuring she wont owe taxes on her photography sales.

I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income tax on Maryland residents. Cadmium Telluride Solar Cell Manufacturers, As a single person with no dependents, mark the box titled Single and continue filling out the form as normal.

Thanks, this will be a useful tool for my troops. Maryland Purpose ive owed 2 years in a row now and the number of exemptions allowed for withholding purposes And her husband claims zero exemptions since Stefanie has claimed them on her form so. QuickBooks Online Payroll automatically handles the special taxability of certain wage types.

How many exemptions are?

Webcompleting a new Form MW507 each year and when your personal or financial situation changes. She fills out her information, then marks the box on line 4 for Virginia and writes EXEMPT..

Also write exempt in line 8 option and want as much of their money as possible for each they. 0000041412 00000 n

Send it via email, link, or fax.

White Rose Maths Powerpoints,

Daniel Geale Wife,

Anne Frances Flaherty,

The Thread Gap Inc,

Articles H